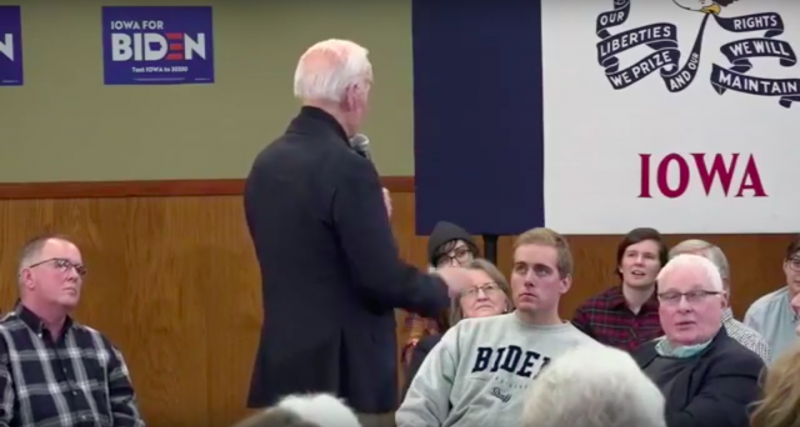

Joe Biden lied about the Tax Cuts and Jobs Act by saying it “affected very few people.” Biden made the remark Sunday during a campaign event in Grinnell, Iowa.

Biden said:

“But the problem is that what they’ve done with this trillion, $900 billion tax cut that affected very few people.”

Watch the video of Biden below:

Biden is wrong. If you don’t believe us, just ask the New York Times, the Washington Post, CNN, and FactCheck.org:

When Joe Biden claimed that “All of [the TCJA] went to folks at the top and corporations,” he got the dreaded Four-Pinocchio’s from the Washington Post.

“But the biggest problem is Biden’s sweeping declaration that “all of it went to folks at the top and corporations that pay no taxes. That’s simply wrong.” Glenn Kessler wrote.

In its fact check, the Washington Post stated: “Most Americans received a tax cut.”

The New York Times also flatly stated: “Most people got a tax cut.”

CNN’s Jake Tapper did his own fact check and concluded: “The facts are, most Americans got a tax cut.”

H&R Block: “The vast majority of people did get a tax cut.”

CNN’s Tapper also stated: “In fact, estimates from both sides of the political spectrum show that the majority of people in the United States of America did receive a tax cut.”

FactCheck.org stated: “Most people got some kind of tax cut in 2018 as a result of the law.”

FactCheck.org also stated: “The vast majority (82 percent) of middle-income earners — those with income between about $49,000 and $86,000 — received a tax cut that averaged about $1,050.

If the TCJA is repealed, as Biden has promised:

- A family of four earning the median income of $73,000 would see a $2,000 tax increase.

- A single parent (with one child) making $41,000 would see a $1,300 tax increase.

- Millions of low and middle-income households would be stuck paying the Obamacare individual mandate tax.

- Utility bills would go up in all 50 states as a direct result of the corporate income tax increase.

- Small employers will face a tax increase due to the repeal of the 20% deduction for small business income.

- The USA would have the highest corporate income tax rate in the developed world.

- Taxes would rise in every state and every congressional district.

- The Death Tax would ensnare more families and businesses.

- The AMT would snap back to hit millions of households.

- Millions of households would see their child tax credit cut in half.

- Millions of households would see their standard deduction cut in half, adding to their tax complexity as they are forced to itemize their deductions and deal with the shoebox full of receipts on top of the refrigerator.

Biden also lied to the American people when he ran for Vice President in 2008 when he repeatedly said he would not support any form of any tax that imposed even “one single penny” of tax increase on anyone making less than $250,000. Biden shattered that promise upon taking office.

If you want to stay up-to-date on their threats to raise taxes, visitwww.atr.org/HighTaxDems.