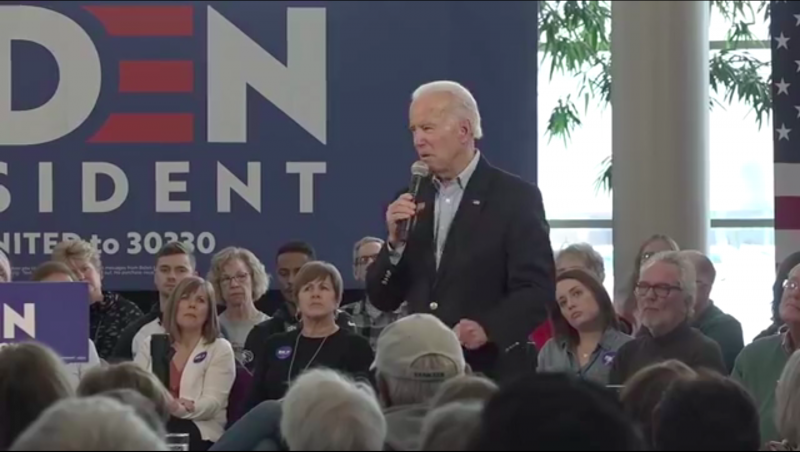

Joe Biden lied about his healthcare plan on Monday during a townhall in Iowa and erroneously claimed that “no middle class tax increase” would occur under his healthcare proposal.

“Middle class people have an opportunity in a right to be able to be covered and you get full coverage under my proposal, and I tell you what it costs and no middle class tax is going to occur. Period.“

Biden is wrong, since his campaign told the New York Times that his healthcare plan would repeal the Tax Cuts and Jobs Act, which would result in a massive tax increase on the middle class.

“Speaking to reporters on Sunday, officials with Mr. Biden’s campaign said his plan would cost $750 billion over 10 years and would be financed by rolling back the $1.5 trillion tax cut Congress passed last year and doubling the tax rate on capital gains for the wealthiest Americans — those with annual incomes of more than $1 million,” Biden’s campaign told the NYT.

Biden’s promise to repeal the tax cuts is a promise to raise taxes. If the tax cuts were repealed:

- A family of four earning the median income of $73,000 would see a $2,000 tax increase.

- A single parent (with one child) making $41,000 would see a $1,300 tax increase.

- Millions of low and middle-income households would be stuck paying the Obamacare individual mandate tax.

- Utility bills would go up in all 50 states as a direct result of the corporate income tax increase.

- Small employers will face a tax increase due to the repeal of the 20% deduction for small business income.

- The USA would have the highest corporate income tax rate in the developed world, higher than the United Kingdom (19 percent), China (25 percent), Canada (26.8 percent), and Ireland (12.5 percent).

- Taxes would rise in every state and every congressional district.

- The Death Tax would ensnare more families and businesses.

- The AMT would snap back to hit millions of households.

- Millions of households would see their child tax credit cut in half.

- Millions of households would see their standard deduction cut in half, adding to their tax complexity as they are forced to itemize their deductions and deal with the shoebox full of receipts on top of the refrigerator.

In Iowa, where Biden made this claim, households making the average income of $58,570 revieved a tax cut of around $1,423.99, according to a Tax Foundation report.

Still don’t believe us? Take it from left-leaning and establishment media outlets who confirm that the Tax Cuts and Jobs Act helped middle class Americans:

- The New York Times also flatly stated: “Most people got a tax cut.”

- CNN’s Jake Tapper did his own fact check and concluded: “The facts are, most Americans got a tax cut.”

- H&R Block: “The vast majority of people did get a tax cut.”

- CNN’s Jake Tapper also stated: “In fact, estimates from both sides of the political spectrum show that the majority of people in the United States of America did receive a tax cut.”

- FactCheck.org stated: “Most people got some kind of tax cut in 2018 as a result of the law.”

- FactCheck.org also stated: “The vast majority (82 percent) of middle-income earners — those with income between about $49,000 and $86,000 — received a tax cut that averaged about $1,050.

- The NYT also stated: “To a large degree, the gap between perception and reality on the tax cuts appears to flow from a sustained — and misleading — effort by liberal opponents of the law to brand it as a broad middle-class tax increase.”

If you want to stay up-to-date on their threats to raise taxes, visit www.atr.org/HighTaxDems.