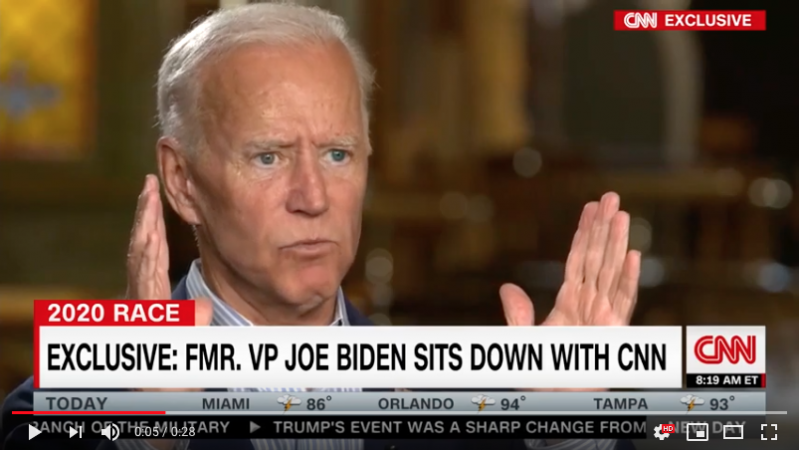

Asked by CNN how he would help the middle class, Biden responds with three tax hikes

Joe Biden will raise the U.S. corporate income tax rate to 28 percent if he wins the presidency, he told CNN.

Asked by host Chris Cuomo how he would help the middle class, Biden immediately proposed three tax increases: a personal income tax rate increase, a capital gains tax increase, and a corporate income tax increase:

[Click here to watch]

“Well, three things. One, I do raise the tax rate to 39.5 percent. I do, in fact, eliminate the ability for them to write off capital gains the way they do now. I would raise the — and raise billions of dollars — raise the corporate tax rate from 20 percent to 28 percent.”

The Tax Cuts and Jobs Act permanently cut the corporate rate from 35 percent to 21 percent.

The Biden 28 percent rate would give the U.S. a higher rate than the United Kingdom (19 percent), China (25 percent), Canada (26.8 percent), and Ireland (12.5 percent). It would impose a tax rate higher than the current combined corporate rate across the 36 member Organisation for Economic Development and Cooperation (OECD), which is currently 23.7 percent.

“Hiking the tax rate on American businesses will kill jobs, lower wages, and reduce new investment in America,” said Grover Norquist, president of Americans for Tax Reform. “Why does Biden want to damage American competitiveness and job creation?”

An increase in the corporate tax rate would directly raise the cost of utility bills in all 50 states.

Biden has also repeatedly threatened a full repeal of the Tax Cuts and Jobs Act.

“First thing I’d do is repeal those Trump tax cuts,” said Biden during a campaign stop in Columbia, South Carolina on May 4.

Biden also continues to lie about the tax cuts. The Washington Post gave Biden four pinocchios when he said: “All of it went to folks at the top and corporations.” In its fact check, the Washington Post stated: “Most Americans received a tax cut.”

Even left-leaning and establishment media outlets confirm the good news arising from the Tax Cuts and Jobs Act:

- The New York Times also flatly stated: “Most people got a tax cut.”

- CNN’s Jake Tapper did his own fact check and concluded: “The facts are, most Americans got a tax cut.”

- CNN’s Jake Tapper also stated: “In fact, estimates from both sides of the political spectrum show that the majority of people in the United States of America did receive a tax cut.”

- FactCheck.org stated: “Most people got some kind of tax cut in 2018 as a result of the law.”

- FactCheck.org also stated: “The vast majority (82 percent) of middle-income earners — those with income between about $49,000 and $86,000 — received a tax cut that averaged about $1,050.

- The NYT also stated: “To a large degree, the gap between perception and reality on the tax cuts appears to flow from a sustained — and misleading — effort by liberal opponents of the law to brand it as a broad middle-class tax increase.”

See Also: 800 examples of good news arising from the GOP tax cuts