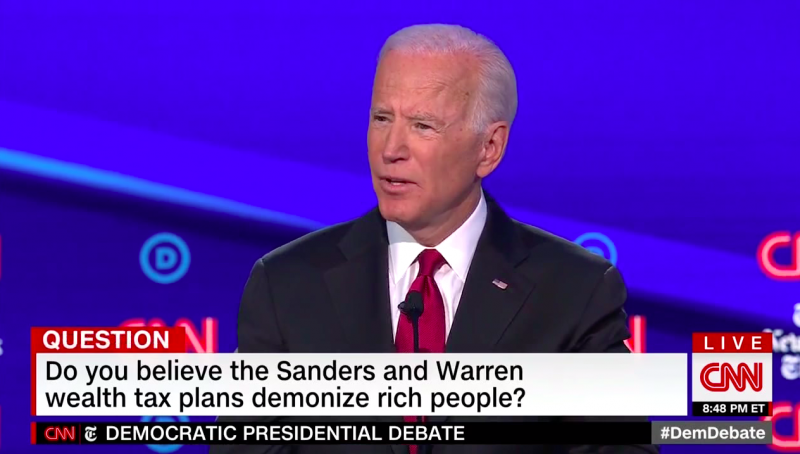

Joe Biden said during the CNN/NYT Democratic debate that he’d double the capital gains tax rate to almost 40% from 20%.

Biden: “I would raise the capital gains tax to the highest rate of 39.5 percent, I would double it.”

In September, Biden said he’d double the capital gains rate to 40%.

Since the launch of his presidential campaign, Biden has repeatedly said the capital gains tax was “too low.” Biden’s comments and his long Senate voting record mean voters should expect him to push for capital gains tax hikes if elected.

During his time in the Senate, Biden consistently voted against tax cuts on capital gains.

In 2003, Biden voted against the reduction in the capital gains rate from 20 percent to 15 percent. In 2005 and 2006, Biden voted against extending the 15 percent rate.

In 2012, then-Vice President Biden and President Obama insisted the cap gains rate revert to 20 percent.

Biden and Obama had already piled on another 3.8 percent capital gains tax hike — the Net Income Investment Tax — one of the many tax increases in Obamacare. The 3.8 percent tax hike took effect Jan. 1, 2013.

Increasing the capital gains tax burden would harm Americans’ ability to build a nest egg and hurt the value of their homes, farms, and businesses.

Currently, long-term capital gains are taxed at zero percent, 15 percent, or 20 percent, depending on household income level the year the gain was realized. Households subject to Obamacare’s 3.8 percent Net Income Investment Tax pay a 23.8% rate.

In August Biden called for a capital gains tax rate increase to 39.6 percent. If Biden is elected and raises the rate to his most recently stated 40 percent, the top capital gains tax rate would end up at 43.8 percent.

If you want to stay up-to-date on Democratic candidates and their threats to raise taxes, visit www.atr.org/HighTaxDems.