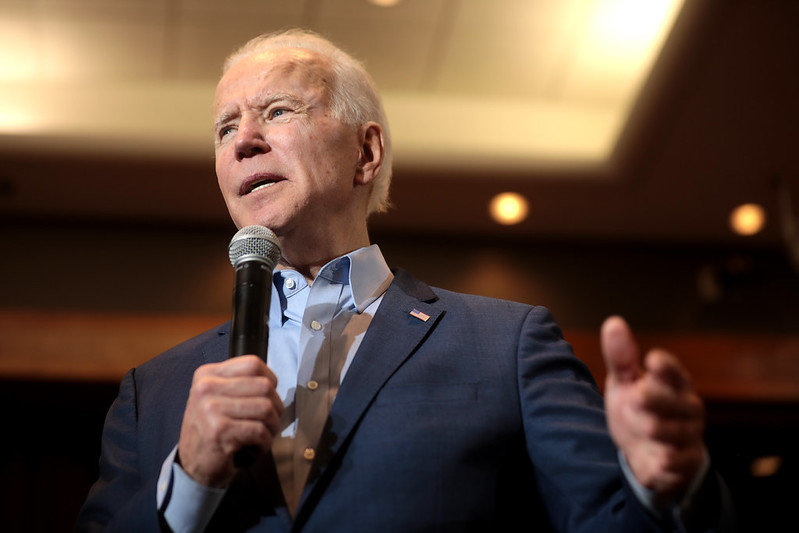

Vermont Senator Bernie Sanders endorsed Joe Biden for the Presidency on April 13, 2020, one week after dropping out of the Democratic Presidential Primary. The following day, Former President Barrack Obama also endorsed Biden, calling him the most progressive nominee in history.

With the endorsement, Senator Sanders aims to bring his extremely leftist supporters to Joe Biden’s Democratic base, by persuading him to carry the mantle forward on his progressive financial policies. According to Politico, “Their staffs have in recent days met to discuss establishing six task forces — concerning the economy, education, criminal justice, immigration, climate change and healthcare — to bridge any gaps between the two wings of the Democratic Party.” Fellow Presidential Candidate Senator Elizabeth Warren, who shares support amongst Sander’s supporters also endorsed Biden, and it’s obvious both Senators and Warren wish to play a role in a Biden Presidency. Should Senator Sanders command the economic task force, he could use his role to pull Biden further to the left and return to his Presidential candidate plan as a blueprint.

Under Sanders’ “Fair Banking for All” proposal, he sought to transform the financial services industry by increasing regulation that would ultimately reduce access to capital for consumers.

In Sanders’ proposal, he advocated for capping consumer loans and credit card interest rates at 15 percent across all financial institutions. Senator Sanders is not the only one who believes in this cap, as does Representative Alexandria Ocasio-Cortez, who introduced a bill in the House of Representatives titled the Loan Shark Prevention Act to cap loans and credit card interest rates at 15 percent. In theory, this may sound positive, but consumers will be directly impacted by these policies and instead pay higher credit card fees.

Credit cards operate primarily as payment networks that process millions of payments under $10 daily, scan for fraud, and provide billions in rewards to their customers who use their products issued by banks or credit unions. With their high operation costs, implementing price ceilings on payment companies reduces the amount of cards and services that they can afford to provide forcing them to charge higher annual fees and reducing rewards programs enjoyed by millions of customers.

Both Sanders and Biden have a record of supporting increased regulations on financial institutions. For example, Senator Sanders proudly voted in favor of the Dodd-Frank Act saying, “I voted for Dodd-Frank, got an important amendment in it, [in] my view, it doesn’t go anywhere near far enough.” On the other hand, Biden has constantly praised the bill and its creation of Consumer Financial Protection Bureau by saying, “I got votes for that bill. I convinced people to vote for it. So, let’s get those things straight too.”

With the Dodd-Frank’s regulatory mandates and resulting compliance costs, it has been expensive for banks to make loans or service customers that have no credit history or credit score. These compliance costs have changed how banks operate and conduct business and spend more than 10% of their operating costs on compliance, an estimated $270 billion per year.

Last year, President Trump signed into law the Economic Consumer Relief and Protection Act reforming the regulatory environment created under Dodd-Frank that has hindered consumers and small business’ access to capital while exempting community banks and credit unions from overregulation. Sanders voted against the legislation, despite the policy making it easier for less affluent Americans to have access to bank accounts and credit. Like Sanders, Biden may also support reversing the pro-growth legislation if Sander’s task force recommendations call for it.

Sanders’ Presidential agenda called for the US Postal Service to offer banking services like checking and savings accounts, debit cards, direct deposit, online banking services, and low-interest small dollar loans. The USPS has failed to turn a profit for 12 consecutive years losing $3.9 billion last year, and with its abysmal customer service and inefficiency in delivering first class mail, how can we entrust them with our financial information? With Bloomberg, Sanders, and Warren encouraging postal banking, Biden may be convinced to support USPS banking as well.

Like Sanders, Biden will likely bring back Obama-era short-term loan policy regulations that force borrowers to disclose their income, borrowing history, and require lenders to assess the borrower’s ability-to-repay a loan. For consumers or small businesses that have to make a payment immediately, this will force borrowers to obtain payments in a quicker fashion, perhaps turning them towards illegal loan sharks.

Senator Sander’s endorsement comes at a crucial time for Biden when is being urged from progressive groups to go further to the left . In his virtual endorsement, Sanders hopes the task forces will help bring unity between both campaigns and supporters, to which Biden promised not to let Sanders down. This means that Biden must pander to the Bernie supporters of the Democrat Party and their socialist policy goals to win their support, making him as dangerous as Sanders.