USA-CHINA/ under CC BY-SA 2.0

USA-CHINA/ under CC BY-SA 2.0

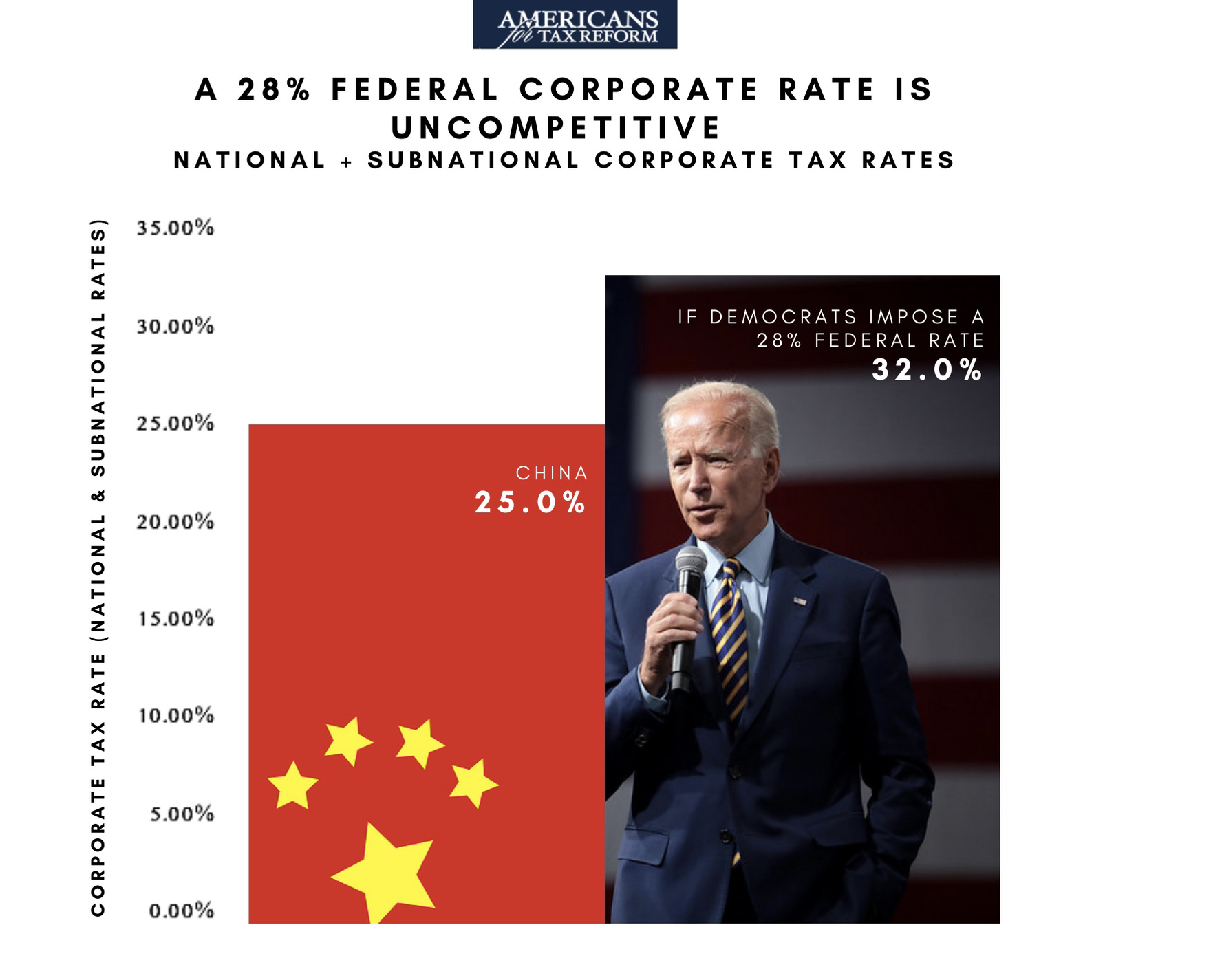

In his new budget, President Biden raises the current 21% federal corporate income tax rate to 28%, higher than Communist China’s 25%. Industry sectors of strategic use to the Chinese government pay a lower rate of 15% or even 10%.

After adding state corporate income taxes, the combined federal-state rate under Biden amounts to about 32%.

See the comparison below:

“A corporate tax hike will decrease wages, increase prices, and hurt American competitiveness,” said Grover Norquist, president of Americans for Tax Reform.

American workers would bear the brunt of Biden’s corporate tax increase.

The non-partisan Joint Committee on Taxation affirmed in congressional testimony that corporate tax rate hikes hit “labor, laborers.“

Testifying before the House Ways & Means Committee, JCT Chief of Staff Thomas A. Barthold said:

“Literature suggests that 25% of the burden of the corporate tax may be borne by labor in terms of diminished wage growth.”

Economists across the political spectrum agree that workers bear the brunt of corporate tax increases.

According to Stephen Entin of the Tax Foundation, workers bear an estimated 70 percent of the corporate income tax. He wrote in 2017:

“Over the last few decades, economists have used empirical studies to estimate the degree to which the corporate tax falls on labor and capital, in part by noting an inverse correlation between corporate taxes and wages and employment. These studies appear to show that labor bears between 50 percent and 100 percent of the burden of the corporate income tax, with 70 percent or higher the most likely outcome.”

A 2012 Harvard Business Review piece by Mihir A. Desai notes that raising the corporate tax lands “straight on the back” of the American worker and will see a decline in real wages.

A 2012 paper at the University of Warwick and University of Oxford found that a $1 increase in the corporate tax reduces wages by 92 cents in the long term. This study was conducted by Wiji Arulampalam, Michael P. Devereux, and Giorgia Maffini and studied over 55,000 businesses located in nine European countries over the period 1996-2003.

Even the left-of-center Tax Policy Center estimates that 20 percent of the burden of the corporate income tax is borne by labor.

While Biden likes to pretend his tax increases are for Scrooge McDuck and Rich Uncle Pennybags, everyone gets hit.