Featured Posts

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Filtered Posts

One Way to Reform the IRS is Through Passing the Refund Rights for Taxpayers Act

Rep. Guthrie Proposal Should Be Part of the Solution to Increase Acesss to Healthcare

IPAB Should Be Repealed

ATR Supports Representative Johnson’s “No Bonuses for Tax Delinquent IRS Employees” Act

Coalition Urges Support for Increased Oversight Over CMMI

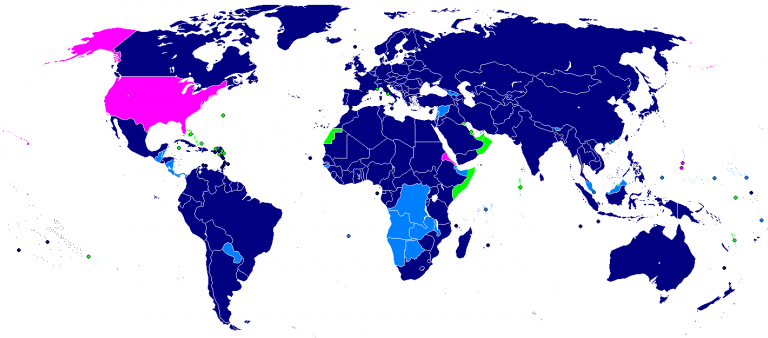

Tax Reform Should Include Territoriality for Individuals

ATR Suports the ABLE Act to Help Families with Disabled Children

ATR Supports Congressman Posey’s Seniors’ Tax Simplification Act