Featured Posts

Healthcare

JAMA Study on Price of Diabetes Medicines is Deceiving and Threatens Medical Innovation

In a recent study by the activist-funded JAMA Network, researchers erroneously “determined” that the price of diabetes medicines, like insulins, SGLT2 inhibitors, and…

Taxpayer Protection Pledge

Jefferson Shreve Makes “No New Taxes” Promise to Voters in IN-06 Race

Americans for Tax Reform (ATR) commends Jefferson Shreve for signing the Taxpayer Protection Pledge, a written commitment to the voters of Indiana…

Spending & Regulatory Reform, Tax Reform

New Jersey Governor Phil Murphy Betrays No Tax Increase Promise, Returns to Tax-and-Spend Ways

Record spending and a return to pushing tax hikes, that is the unfortunate reality of New Jersey Governor Phil Murphy’s budget proposal. Just last year,…

Filtered Posts

Regulation, Trade

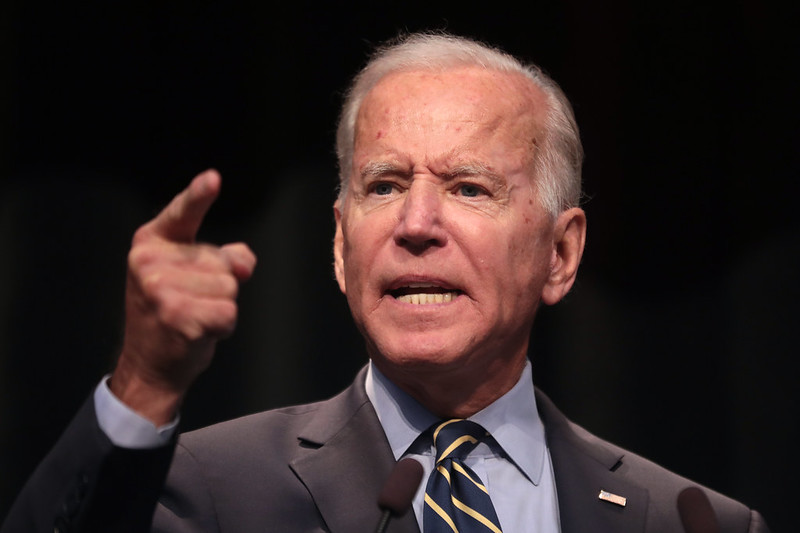

Three Things To Know About Biden’s Misguided Opposition to Nippon Deal

Regulation, Trade

Five Takeaways from House Judiciary’s Bombshell Report on Lina Khan’s Runaway FTC

Regulation, Trade

Nippon Steel Deal Would Benefit American Workers and Global Competitiveness

Tech & Telecom, Trade

30 Free Market Groups and Activists Oppose Biden’s Surrender on Digital Trade

Trade

USTR Announcement Is A Giveaway To Progressive Activists

Spending & Regulatory Reform

“Swifties” Shouldn’t Trick Republicans Into Empowering Woke FTC

Consumer Affairs

Five Takeaways from Lina Khan’s House Judiciary Testimony

Consumer Affairs

Lina Khan Has Some Explaining To Do

Spending & Regulatory Reform

Klobuchar’s Pet Project Comes Back With A Whimper

Consumer Affairs