Featured Posts

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Spending & Regulatory Reform, Tax Reform

Worst of Both Worlds: U.S. Economic Growth Slows as Inflation Rates Rise

Today, the Commerce Department released a snapshot of its growth report for the first quarter. The country’s gross domestic product (GDP) grew by just…

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Filtered Posts

Regulation, Trade

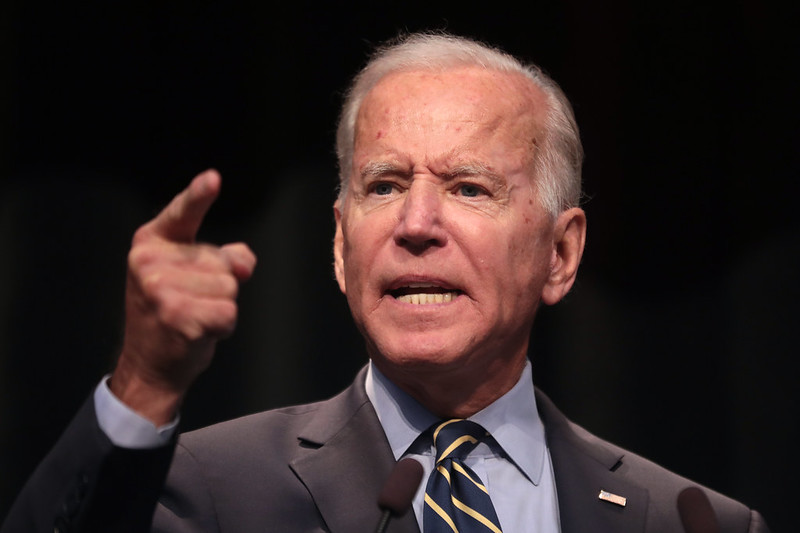

Three Things To Know About Biden’s Misguided Opposition to Nippon Deal

Regulation, Trade

Five Takeaways from House Judiciary’s Bombshell Report on Lina Khan’s Runaway FTC

Regulation, Trade

Nippon Steel Deal Would Benefit American Workers and Global Competitiveness

Tech & Telecom, Trade

30 Free Market Groups and Activists Oppose Biden’s Surrender on Digital Trade

Trade

USTR Announcement Is A Giveaway To Progressive Activists

Spending & Regulatory Reform

“Swifties” Shouldn’t Trick Republicans Into Empowering Woke FTC

Consumer Affairs

Five Takeaways from Lina Khan’s House Judiciary Testimony

Consumer Affairs

Lina Khan Has Some Explaining To Do

Spending & Regulatory Reform

Klobuchar’s Pet Project Comes Back With A Whimper

Consumer Affairs