Featured Posts

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Tax Reform

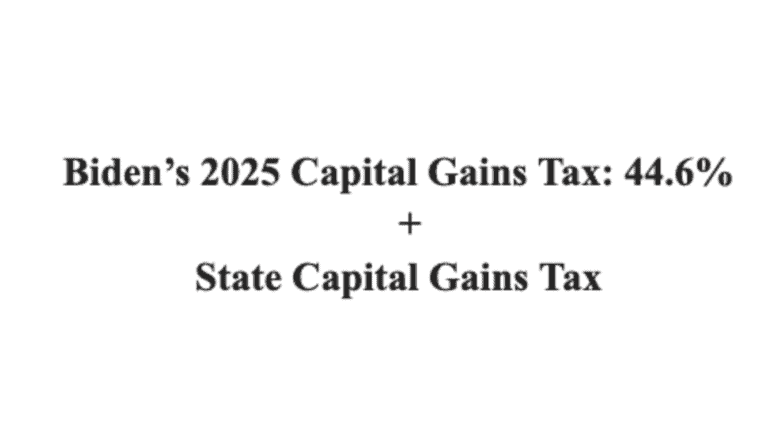

Biden Calls for 44.6% Capital Gains Tax Rate, Highest Capital Gains Tax Since Its Creation in 1922

And don’t forget to add the state capital gains tax: the Biden combined federal-state rate would exceed 50% in many states President Biden has…

Trade

ATR Applauds House Oversight For Investigating FTC-DOJ Strike Force

The House Committee on Oversight and Accountability is launching a probe into the rampant politicization of the Federal Trade Commission (FTC) by Chair Lina Khan…

Filtered Posts

Regulation, Trade

Three Things To Know About Biden’s Misguided Opposition to Nippon Deal

Regulation, Trade

Five Takeaways from House Judiciary’s Bombshell Report on Lina Khan’s Runaway FTC

Regulation, Trade

Nippon Steel Deal Would Benefit American Workers and Global Competitiveness

Tech & Telecom, Trade

30 Free Market Groups and Activists Oppose Biden’s Surrender on Digital Trade

Trade

USTR Announcement Is A Giveaway To Progressive Activists

Spending & Regulatory Reform

“Swifties” Shouldn’t Trick Republicans Into Empowering Woke FTC

Consumer Affairs

Five Takeaways from Lina Khan’s House Judiciary Testimony

Consumer Affairs

Lina Khan Has Some Explaining To Do

Spending & Regulatory Reform

Klobuchar’s Pet Project Comes Back With A Whimper

Consumer Affairs