Featured Posts

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Filtered Posts

Clock Expires on Dangerous New York “Anti-Trust” Expansion, For This Year…

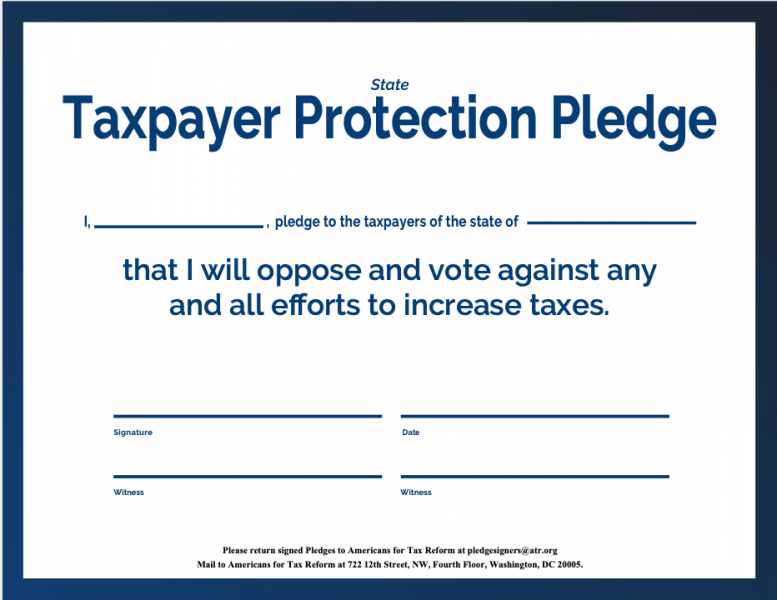

Taxpayer Protection Pledge Signer Jack Ciattarelli Wins NJ Gubernatorial Primary

ATR Releases List of 2021 NJ State Pledge Signers (Primary Election)

New York Takes Federal Bailout, Raises Taxes Anyways

ATR Releases List of 2021 VA State Taxpayer Protection Pledge Signers (Primary Election)

California Raises Tobacco Taxes…Again

Virginia Taxpayers can count on Youngkin, Sears, and Miyares

American Rescue Plan Blocks Tax Cuts, Multiple States File Lawsuits Against Biden Administration

Maine Lawmakers Not Afraid To Propose Tax Hikes During Pandemic Recovery