Featured Posts

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Tax Reform

Biden: Tax cuts “are going to stay expired and dead forever if I’m re-elected.”

Biden announces intention to break his $400k tax pledge Today President Biden said that if elected to a second term he will make sure…

Taxpayer Protection Pledge

Brad Knott Makes “No New Taxes” Promise to Voters in NC-13 Run-off

Americans for Tax Reform (ATR) commends former federal prosecutor Brad Knott for signing the Taxpayer Protection Pledge,…

Filtered Posts

Oregon Bike Tax Proves Nothing is Safe from Taxation

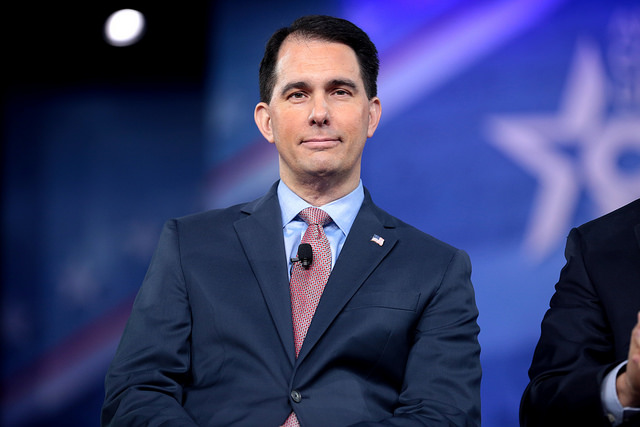

Foxconn Deal Demonstrates Success of Gov. Walker’s Reforms

Pennsylvania’s Budget Funding Quandary

Illinois on the Brink of Another Budget Disaster

Anthem’s Exit Further Demonstrates Need to Repeal Obamacare