Featured Posts

Healthcare

JAMA Study on Price of Diabetes Medicines is Deceiving and Threatens Medical Innovation

In a recent study by the activist-funded JAMA Network, researchers erroneously “determined” that the price of diabetes medicines, like insulins, SGLT2 inhibitors, and…

Taxpayer Protection Pledge

Jefferson Shreve Makes “No New Taxes” Promise to Voters in IN-06 Race

Americans for Tax Reform (ATR) commends Jefferson Shreve for signing the Taxpayer Protection Pledge, a written commitment to the voters of Indiana…

Spending & Regulatory Reform, Tax Reform

New Jersey Governor Phil Murphy Betrays No Tax Increase Promise, Returns to Tax-and-Spend Ways

Record spending and a return to pushing tax hikes, that is the unfortunate reality of New Jersey Governor Phil Murphy’s budget proposal. Just last year,…

Filtered Posts

ATR Statement on Permanent Tax Extenders Bill

Fact Checking Tammy Baldwin on Carried Interest Tax Hikes

ATR Supports H.R. 3762, the “Restoring Americans’ Healthcare Freedom Reconciliation Act of 2015”

ATR Analysis of John Kasich Tax Plan

ATR Analysis of Rick Santorum Tax Plan

Open Letter to Congress on Bonus Depreciation

Puerto Rico Should Adopt Enterprise Zones, Not Austerity Tax Hikes

ATR Analysis of Donald Trump Tax Reform Plan

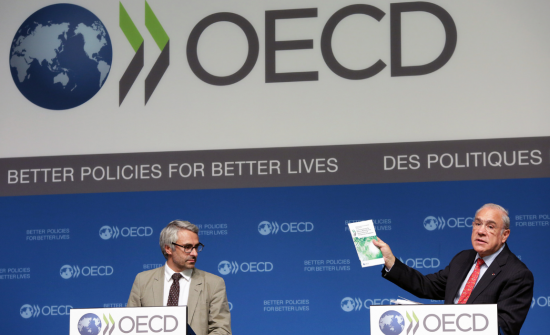

BEPS Is a French Acronym for “Tax Hikes”