Featured Posts

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Financial Services

ATR Supports Fight Against SEC’s Climate Rule

On March 21, 2022, the Securities and Exchange Commission (SEC) introduced a proposed rulemaking that required publicly traded companies to disclose information…

Financial Services

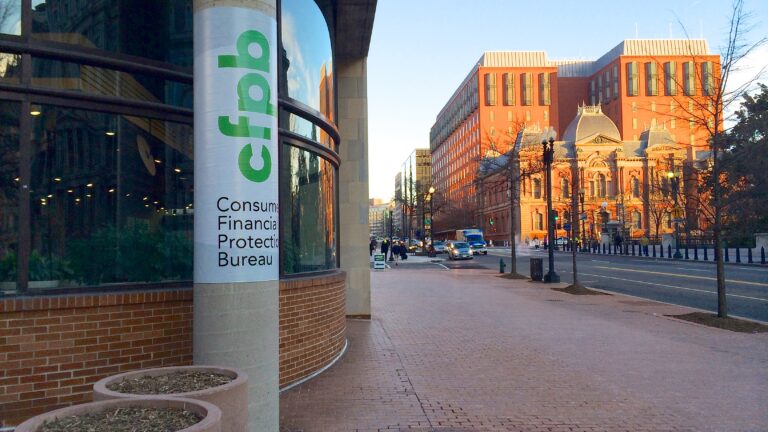

ATR Supports Fight Against CFPB’s Credit Card Late Fee Rule

Without any direction from Congress, the Consumer Financial Protection Bureau (CFPB) finalized a rule that (1) changes the safe harbor dollar amount for late fees…

Filtered Posts

ATR Urges Arizona Lawmakers to Reject Tax Hikes

ATR Urges Utah Lawmakers to Reject Harmful Tax Hike

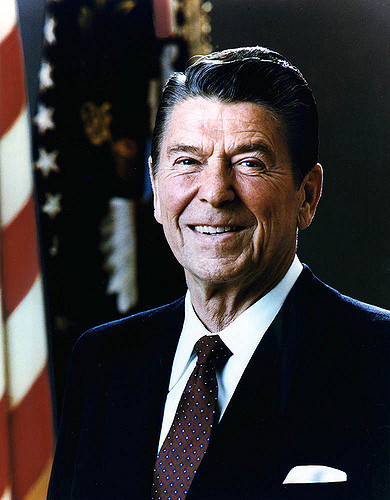

Reagan Legacy Project Highlights Overseas Dedications to President Reagan

Dems Pull Widely Panned Power Move in NJ, While Complaining About WI

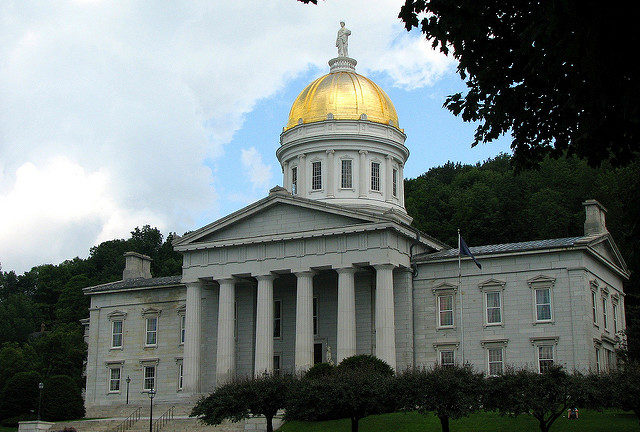

ATR Urges Vermont Lawmakers to Reject Opioid Tax Hikes

Connecticut Lawmakers Hold Hearing on Carbon Tax Legislation, Which is Proliferating in State Capitols

ATR Applauds Efforts to Repeal Gov. Jerry Brown’s Gas Tax Hike

DeVos Confirmation a Victory for Families Nationwide

ATR Supports Renaming Gravelly Point Park To Nancy Reagan Memorial Park