Featured Posts

Education

Biden’s Student Loan Cancellation Plan Will Only Worsen a Larger Problem in Higher Education

Last week, President Biden visited Madison, Wisconsin where he announced new details for his student debt cancellation plan. While this initiative promises immediate short-term financial…

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Spending & Regulatory Reform, Tax Reform

Worst of Both Worlds: U.S. Economic Growth Slows as Inflation Rates Rise

Today, the Commerce Department released a snapshot of its growth report for the first quarter. The country’s gross domestic product (GDP) grew by just…

Filtered Posts

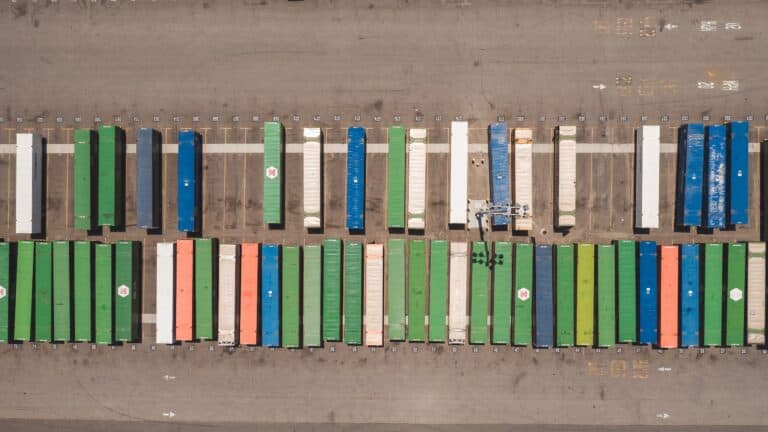

Trade

Global Steel and Aluminum Deal Haunts Biden Industrial Planners

Trade

Keep EU Hands Off Americans’ Right to Work

News

United States Falls Behind on Trade Barrier Index

Tax Reform

ATR Supports Sen. Toomey’s Motion to Instruct Competes Act Conferees to Re-Establish the Section 301 Tariff Exclusions Process

Absent the U.S. Others Gain in CPTPP

EU Rules Haunt U.S.-UK Trade

Open trade helps Americans do more of what they do best