Featured Posts

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Financial Services

ATR Supports Fight Against SEC’s Climate Rule

On March 21, 2022, the Securities and Exchange Commission (SEC) introduced a proposed rulemaking that required publicly traded companies to disclose information…

Financial Services

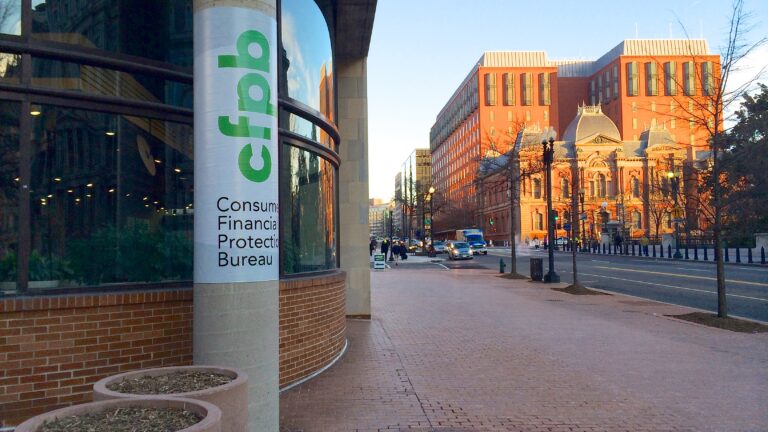

ATR Supports Fight Against CFPB’s Credit Card Late Fee Rule

Without any direction from Congress, the Consumer Financial Protection Bureau (CFPB) finalized a rule that (1) changes the safe harbor dollar amount for late fees…

Filtered Posts

Connecticut Legislators Propose Income Tax Hike

Louisiana Labor Committee Passes Paycheck Protection Bill

North Carolina Senators Propose Corporate Tax Relief

Beer Tax Relief on Tap in Congress & State Capitals

ATR Urges South Carolina Legislators to Support Governor Nikki Haley’s Proposal to Reduce the State’s Income Tax

Nikki Haley Is Leading The Southern Tax Reform Charge

ATR Applauds South Carolina Gov. Nikki Haley’s Call for Income Tax Relief

Contrasting Records a Feature of the North Carolina Senate Race

NC Newspaper Issues Misguided Call for a Plastic Bag Ban