Featured Posts

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Filtered Posts

Connecticut Legislators Propose Income Tax Hike

Louisiana Labor Committee Passes Paycheck Protection Bill

North Carolina Senators Propose Corporate Tax Relief

Beer Tax Relief on Tap in Congress & State Capitals

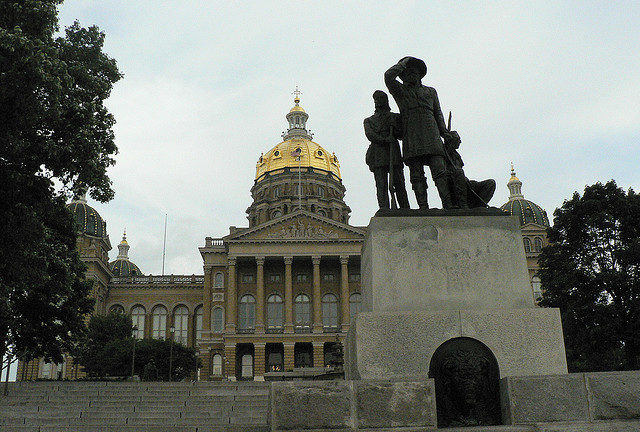

ATR Urges South Carolina Legislators to Support Governor Nikki Haley’s Proposal to Reduce the State’s Income Tax

Nikki Haley Is Leading The Southern Tax Reform Charge

ATR Applauds South Carolina Gov. Nikki Haley’s Call for Income Tax Relief

Contrasting Records a Feature of the North Carolina Senate Race

NC Newspaper Issues Misguided Call for a Plastic Bag Ban