Featured Posts

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Tax Reform

Biden: Tax cuts “are going to stay expired and dead forever if I’m re-elected.”

Biden announces intention to break his $400k tax pledge Today President Biden said that if elected to a second term he will make sure…

Taxpayer Protection Pledge

Brad Knott Makes “No New Taxes” Promise to Voters in NC-13 Run-off

Americans for Tax Reform (ATR) commends former federal prosecutor Brad Knott for signing the Taxpayer Protection Pledge,…

Filtered Posts

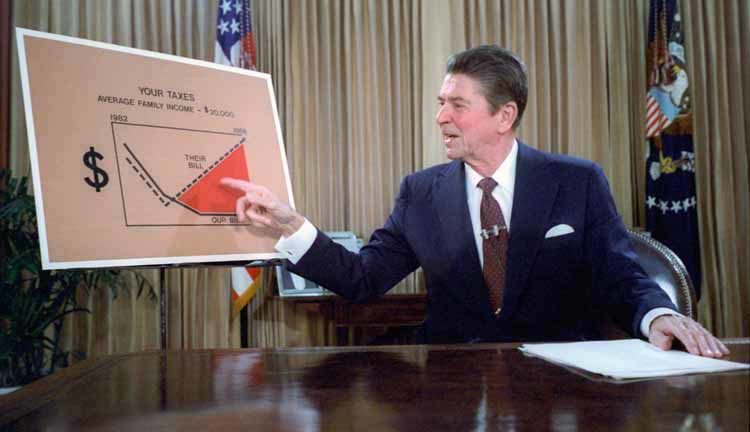

States Could Learn from Reagan’s 1986 Pro-Growth Tax Reform

ATR Congratulates Primary Winners in Mississippi

Leave “My Cash” Alone – Says Oklahoma Sheriff

Calvin Coolidge: Humility at the Highest Office

Alabama Vape Shop Owner Says He’ll Shut Down if Bentley Tax Hikes Pass

ATR Sends Letter Opposing Bentley Tax Hikes

Good & Bad Tax Proposals Being Considered in North Carolina

Dodd-Frank Hammers Small Banks

Obama Administration Significantly Underestimated Impact of Woodwork Effect on Medicaid in States