Featured Posts

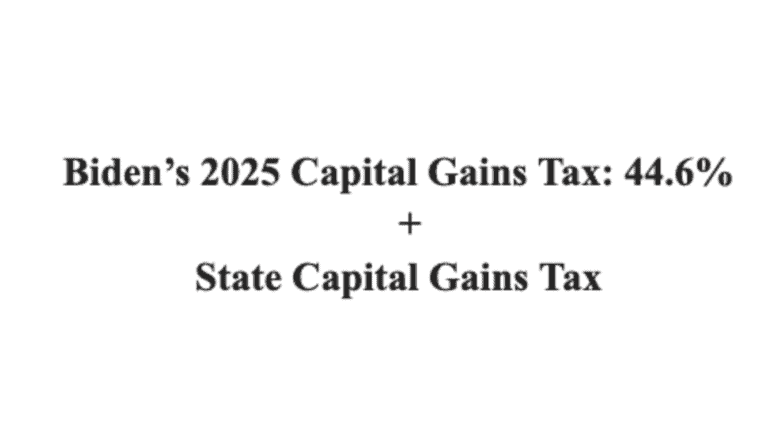

Biden Calls for 44.6% Capital Gains Tax Rate, Highest Capital Gains Tax Since Its Creation in 1922

And don’t forget to add the state capital gains tax: the Biden combined federal-state rate would exceed 50% in many states President Biden has…

Trade

ATR Applauds House Oversight For Investigating FTC-DOJ Strike Force

The House Committee on Oversight and Accountability is launching a probe into the rampant politicization of the Federal Trade Commission (FTC) by Chair Lina Khan…

Taxpayer Protection Pledge

ATR Commends Pennsylvania Pledge Signers Ahead of April 23 Primary

As Pennsylvania Primary voters head to the voting booth, they deserve to know where their candidates stand on crucial issues such as taxes and spending.

Filtered Posts

Highlights of The Sharing Economy

Uber Drivers Earn Significantly More Than Classic Taxi Drivers

Mercatus Study Shows Harmful Effect of Occupational Licensing

Koskinen’s IRS At It Again: Tea Party Groups Denied Tax-exempt Status After Nearly 7 Years

State Tax Ballot Measure Roundup

Hillary Clinton Endorsed a VAT As High As 22 Percent in 1993

Report: Hillary’s State Department Spent $79,000 On Obama Books

Five Tax Takeaways from the Debate

Hillary Can’t Stop Stealing Furniture From the American People