Featured Posts

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Financial Services

ATR Supports Fight Against SEC’s Climate Rule

On March 21, 2022, the Securities and Exchange Commission (SEC) introduced a proposed rulemaking that required publicly traded companies to disclose information…

Financial Services

ATR Supports Fight Against CFPB’s Credit Card Late Fee Rule

Without any direction from Congress, the Consumer Financial Protection Bureau (CFPB) finalized a rule that (1) changes the safe harbor dollar amount for late fees…

Filtered Posts

SpaceX Celebrates Successful Falcon Heavy Launch

Alabama Takes on Juvenile Justice with ATR

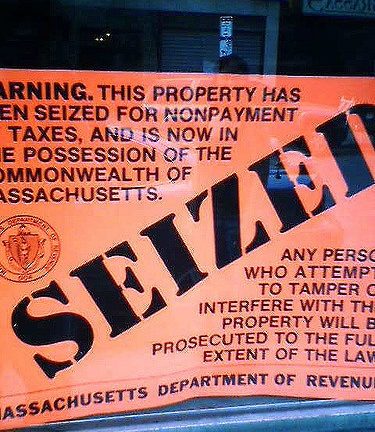

Ohio Senate Must Act to Protect Citizens’ Property Rights in Civil Asset Forfeiture Bill

Justice for All: Oklahomans Vote to Reform the State’s Criminal Justice System

Norquist: Pennsylvania House Needs to Pass Asset Forfeiture Reform This Year

Pence Supports National Criminal Justice Reform that “Removes Institutional Bias”

Pennsylvania SB 869 Supports Citizens’ Fifth Amendment Rights

Congress Acts Unanimously to Prevent IRS from Looting Innocent Taxpayers

Norquist: We Have Come “Too Far” to Let This Effort Die