Featured Posts

Healthcare

JAMA Study on Price of Diabetes Medicines is Deceiving and Threatens Medical Innovation

In a recent study by the activist-funded JAMA Network, researchers erroneously “determined” that the price of diabetes medicines, like insulins, SGLT2 inhibitors, and…

Taxpayer Protection Pledge

Jefferson Shreve Makes “No New Taxes” Promise to Voters in IN-06 Race

Americans for Tax Reform (ATR) commends Jefferson Shreve for signing the Taxpayer Protection Pledge, a written commitment to the voters of Indiana…

Spending & Regulatory Reform, Tax Reform

New Jersey Governor Phil Murphy Betrays No Tax Increase Promise, Returns to Tax-and-Spend Ways

Record spending and a return to pushing tax hikes, that is the unfortunate reality of New Jersey Governor Phil Murphy’s budget proposal. Just last year,…

Filtered Posts

SpaceX Celebrates Successful Falcon Heavy Launch

Alabama Takes on Juvenile Justice with ATR

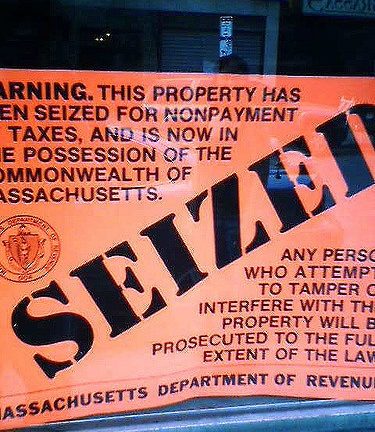

Ohio Senate Must Act to Protect Citizens’ Property Rights in Civil Asset Forfeiture Bill

Justice for All: Oklahomans Vote to Reform the State’s Criminal Justice System

Norquist: Pennsylvania House Needs to Pass Asset Forfeiture Reform This Year

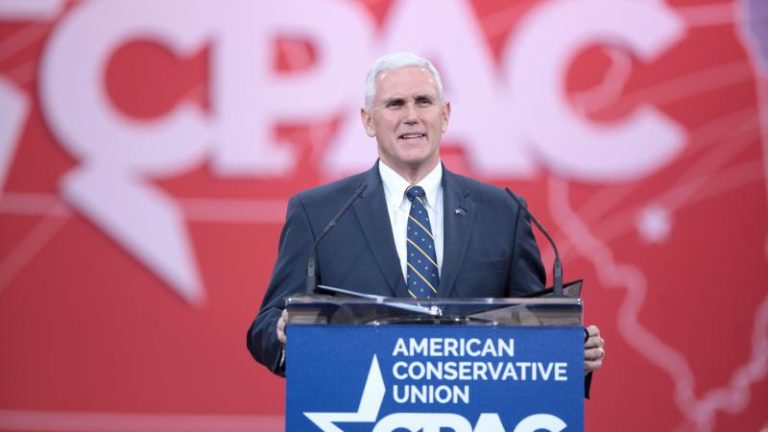

Pence Supports National Criminal Justice Reform that “Removes Institutional Bias”

Pennsylvania SB 869 Supports Citizens’ Fifth Amendment Rights

Congress Acts Unanimously to Prevent IRS from Looting Innocent Taxpayers

Norquist: We Have Come “Too Far” to Let This Effort Die