Featured Posts

Taxpayer Protection Pledge

ATR Commends Pennsylvania Pledge Signers Ahead of April 23 Primary

As Pennsylvania Primary voters head to the voting booth, they deserve to know where their candidates stand on crucial issues such as taxes and spending.

Conservative Movement Leaders Oppose Motion to Vacate

A coalition of more than 40 conservative movement leaders released a letter today urging the House to oppose a vote on the motion to vacate…

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

Filtered Posts

SpaceX Celebrates Successful Falcon Heavy Launch

Alabama Takes on Juvenile Justice with ATR

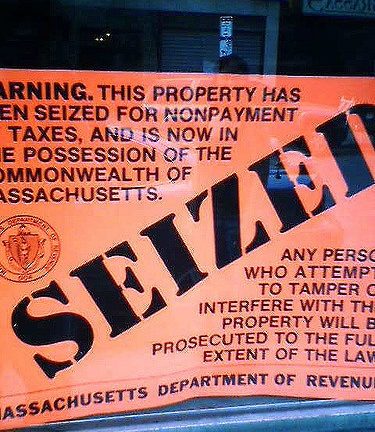

Ohio Senate Must Act to Protect Citizens’ Property Rights in Civil Asset Forfeiture Bill

Justice for All: Oklahomans Vote to Reform the State’s Criminal Justice System

Norquist: Pennsylvania House Needs to Pass Asset Forfeiture Reform This Year

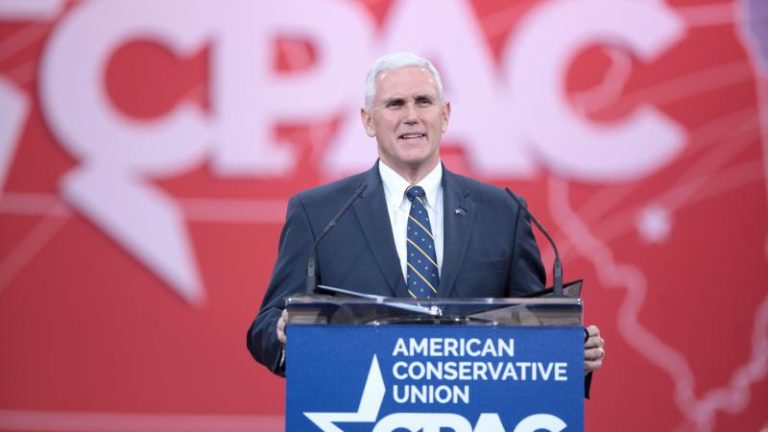

Pence Supports National Criminal Justice Reform that “Removes Institutional Bias”

Pennsylvania SB 869 Supports Citizens’ Fifth Amendment Rights

Congress Acts Unanimously to Prevent IRS from Looting Innocent Taxpayers

Norquist: We Have Come “Too Far” to Let This Effort Die