Featured Posts

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Filtered Posts

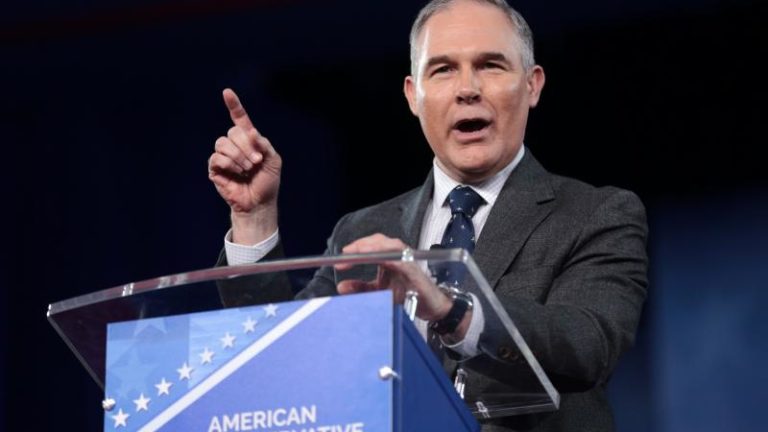

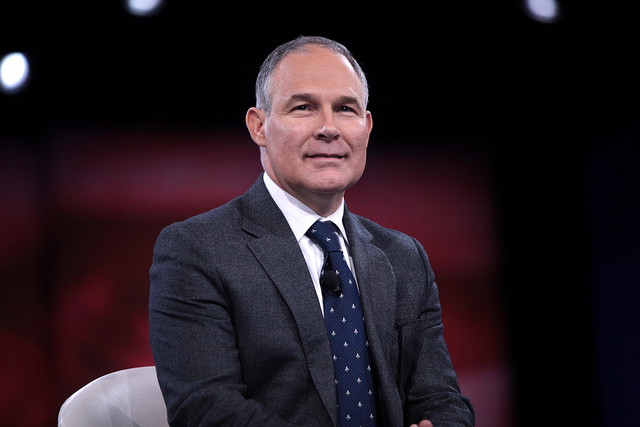

ATR Supports EPA Administrator Pruitt’s Work to Rein In RFS

ATR Support Rep. Mullin’s Amendments on Methane and Social Cost of Carbon

ATR Applauds Secretary Zinke’s Efforts to Improve Antiquities Act Designations

ATR Joins Coalition Calling on Congress to Repeal CFPB Arbitration Rule

ATR Opposes PFC Increase in THUD Appropriations Act

Happy Birthday Dodd-Frank…Hope It’s Your Last!

ATR Applauds Pruitt EPA for Moving to Rescind WOTUS

ATR Urges Senate Lawmakers to Oppose PFC Increase

ATR Urges Support for Davis-Cohen Airport Tax Amendment to House FAA Bill