Featured Posts

Consumer Affairs, Vaping

Biden Abandons Disastrous Menthol Prohibition Plan; Now Washington Needs To Embrace Harm Reduction

In a rare recognition of reality, the Biden Administration today finally agreed to drop their deeply flawed plans to introduce prohibition for Menthol cigarettes…

Education

Biden’s Student Loan Cancellation Plan Will Only Worsen a Larger Problem in Higher Education

Last week, President Biden visited Madison, Wisconsin where he announced new details for his student debt cancellation plan. While this initiative promises immediate short-term financial…

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Filtered Posts

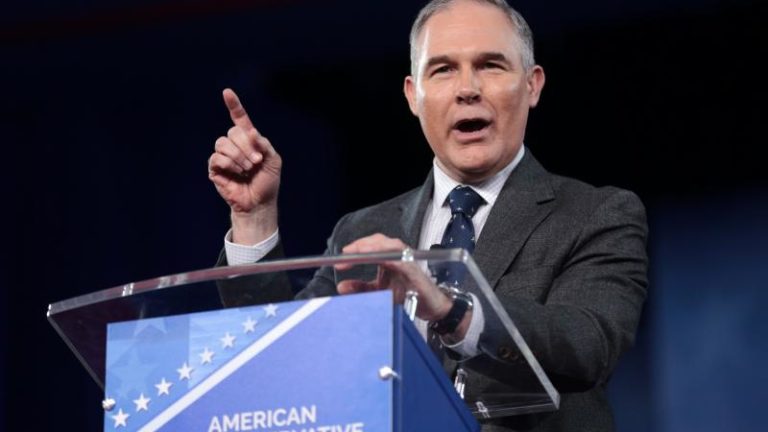

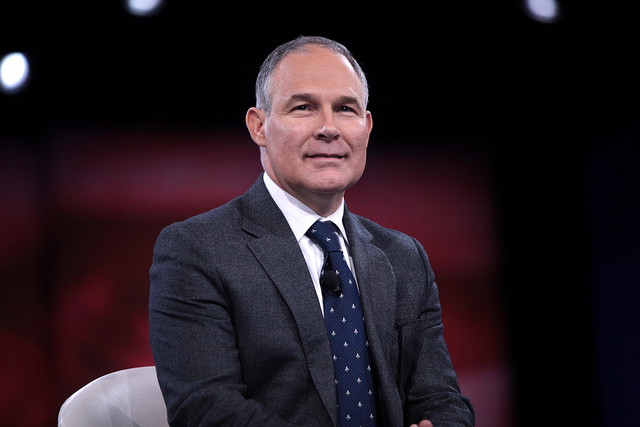

ATR Supports EPA Administrator Pruitt’s Work to Rein In RFS

ATR Support Rep. Mullin’s Amendments on Methane and Social Cost of Carbon

ATR Applauds Secretary Zinke’s Efforts to Improve Antiquities Act Designations

ATR Joins Coalition Calling on Congress to Repeal CFPB Arbitration Rule

ATR Opposes PFC Increase in THUD Appropriations Act

Happy Birthday Dodd-Frank…Hope It’s Your Last!

ATR Applauds Pruitt EPA for Moving to Rescind WOTUS

ATR Urges Senate Lawmakers to Oppose PFC Increase

ATR Urges Support for Davis-Cohen Airport Tax Amendment to House FAA Bill