Featured Posts

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Tax Reform

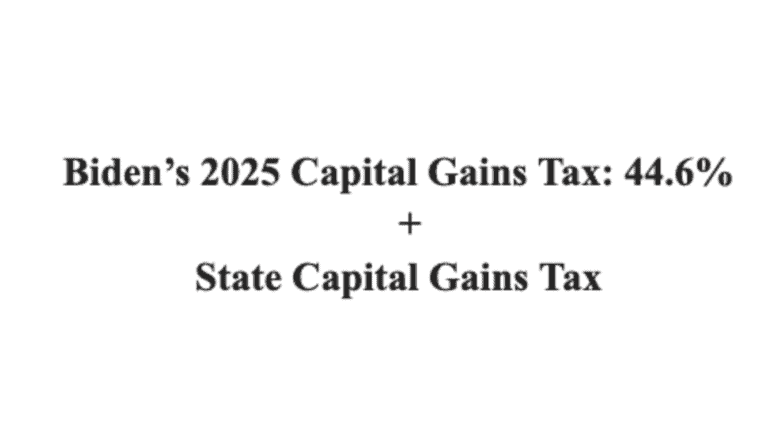

Biden Calls for 44.6% Capital Gains Tax Rate, Highest Capital Gains Tax Since Its Creation in 1922

And don’t forget to add the state capital gains tax: the Biden combined federal-state rate would exceed 50% in many states President Biden has…

Trade

ATR Applauds House Oversight For Investigating FTC-DOJ Strike Force

The House Committee on Oversight and Accountability is launching a probe into the rampant politicization of the Federal Trade Commission (FTC) by Chair Lina Khan…

Filtered Posts

Dodd-Frank is Crushing America’s Credit Unions

Top 5 EPA Reforms That Scott Pruitt Will Likely Push

Nine Dodd-Frank Regulations Congress can Repeal under CRA in 2017

CFPB Should Stop Work on Costly Arbitration Rule

Top 5 Energy Regulations Trump Should Repeal

President Trump Will Rein In CFPB

CFPB Now Subject to Executive Orders Requiring Cost Benefit Analysis

Dodd-Frank is Crushing Small Businesses and Startups in America

Community Banks Under Siege By Dodd-Frank