Featured Posts

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

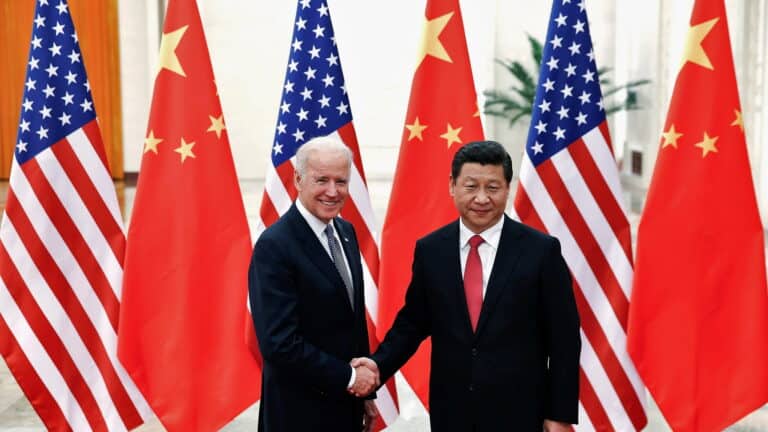

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Filtered Posts

Tax Reform

Biden’s $400k Tax Pledge Now Only Worth $337k

Spending & Regulatory Reform

Biden Budget Deploys 50,000-Person Green New Deal Youth Patrol

Tax Reform

SOTU: Biden Will Lie About GOP Tax Cuts, Again

IRS Watch, Tax Reform

Norquist Warns of the Privacy Risk of IRS “Bring Your Own Device” Program

IRS Watch, Tax Reform

Congresswoman Carol Miller Calls Out IRS Chief for Illegal Actions on 1099-K

IRS Watch, Tax Reform

IRS Chief Won’t Directly State the Number of Guns in IRS Possession

IRS Watch, Tax Reform

IRS Chief Still Hasn’t Explained IRS Destruction of 30 Million Documents

Attorneys General Call Out IRS for Starting “Direct File” Without Congressional Approval

Conservatives Oppose “PROVE IT Act” — a Bill Which Paves the Way for a Carbon Tax on the American People

News, Tax Reform