Featured Posts

Tax Reform

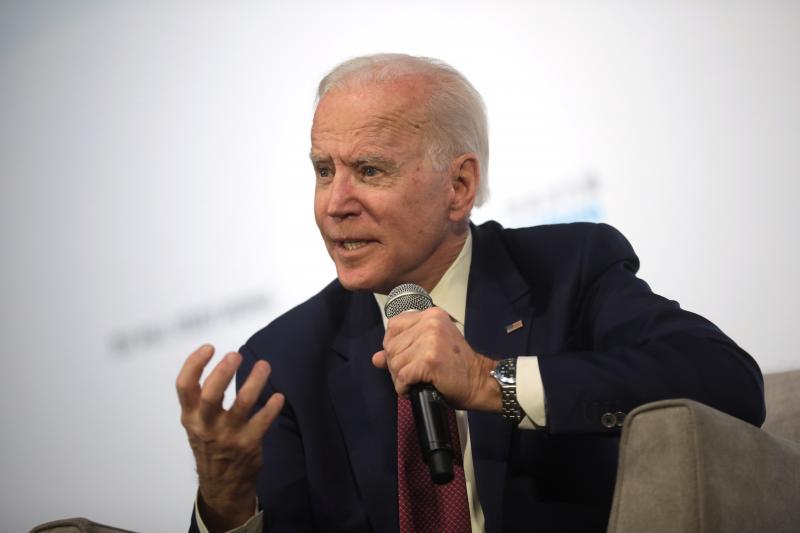

Team Biden Vows to Raise Taxes “Overall” in 2025

President Biden’s top economic advisor, White House National Economic Council Director Lael Brainerd, vowed on Friday that Democrats would raise taxes “overall” in 2025 if…

IRS Watch

Ways & Means Republicans Lead the Way in Protecting Private Taxpayer Data

Yesterday, House Republicans on the Ways & Means Committee took a crucial step in ensuring those who illegally disclose private taxpayer information are held to…

Tax Reform, Tech & Telecom

ATR’s James Erwin Testifies on Defunding NPR before U.S. House Energy and Commerce Subcommittee on Oversight and Investigations

On May 8, 2024, James Erwin, ATR’s Federal Affairs Manager for Telecommunications and Executive Director of Digital Liberty testified before the U.S. House of Representatives…

Filtered Posts

Tax Reform

Biden Wants to Tax Unrealized Gains, but Americans Oppose it 3-1

Higher Corporate Tax Rate = Higher Utility Bills

New Mexico Residents Will Get Stuck with Even Higher Utility Bills Due to Biden Corporate Tax Rate Hike

Oregon Residents Will Get Stuck with Even Higher Utility Bills Due to Biden Corporate Tax Rate Hike

Rhode Island Residents Will Get Stuck with Even Higher Utility Bills Due to Biden Corporate Tax Rate Hike

New York Residents Will Get Stuck with Even Higher Utility Bills Due to Biden Corporate Tax Rate Hike

North Dakotans Will Get Stuck with Higher Utility Bills Due to Biden Corporate Tax Rate Hike

Texas Residents Will Get Stuck with Even Higher Utility Bills Due to Biden Corporate Tax Rate Hike

Manchin’s Corporate Tax Hike Will Stick West Virginians with Higher Utility Bills