Featured Posts

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Spending & Regulatory Reform, Tax Reform

Worst of Both Worlds: U.S. Economic Growth Slows as Inflation Rates Rise

Today, the Commerce Department released a snapshot of its growth report for the first quarter. The country’s gross domestic product (GDP) grew by just…

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Filtered Posts

Healthcare

JAMA Study on Price of Diabetes Medicines is Deceiving and Threatens Medical Innovation

Spending & Regulatory Reform, Tax Reform

RSC Budget Calls for Pro-Growth Tax Cuts and Restraints on Spending

Healthcare

Biden Budget Would Expand Devastating Drug Price Controls

Healthcare

ATR Urges Lawmakers to Oppose Bill that Undermines the Contact Lens Rule

Spending & Regulatory Reform, Tax Reform

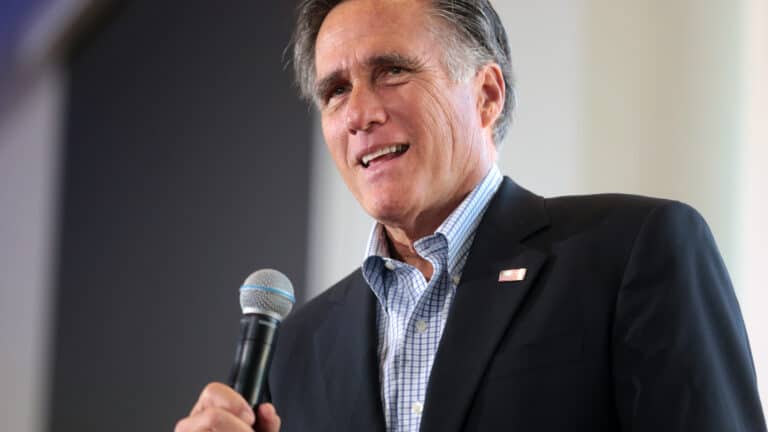

Arrington, Romney Admit Fiscal Commission is Designed to Push Tax Hikes

Spending & Regulatory Reform, Tax Reform

Pro-Tax Hike CRFB Pushes for Romney’s Tax-Trap Commission

Healthcare

Senate HELP Committee to Hold Hearing on Prescription Drug Prices

Healthcare

Medicare Advantage Report Ignores Benefits of Competition in Program

Healthcare, Property Rights

ATR Submits Comments Opposing Misuse of Bayh-Dole March-In Rights