Featured Posts

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Tax Reform

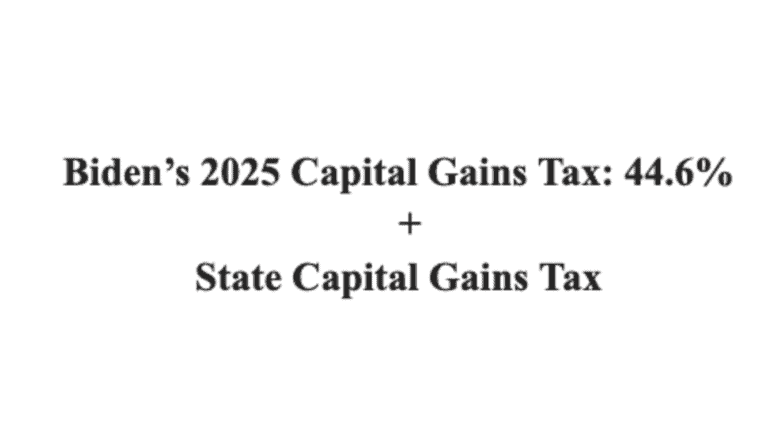

Biden Calls for 44.6% Capital Gains Tax Rate, Highest Capital Gains Tax Since Its Creation in 1922

And don’t forget to add the state capital gains tax: the Biden combined federal-state rate would exceed 50% in many states President Biden has…

Trade

ATR Applauds House Oversight For Investigating FTC-DOJ Strike Force

The House Committee on Oversight and Accountability is launching a probe into the rampant politicization of the Federal Trade Commission (FTC) by Chair Lina Khan…

Filtered Posts

Healthcare

JAMA Study on Price of Diabetes Medicines is Deceiving and Threatens Medical Innovation

Spending & Regulatory Reform, Tax Reform

RSC Budget Calls for Pro-Growth Tax Cuts and Restraints on Spending

Healthcare

Biden Budget Would Expand Devastating Drug Price Controls

Healthcare

ATR Urges Lawmakers to Oppose Bill that Undermines the Contact Lens Rule

Spending & Regulatory Reform, Tax Reform

Arrington, Romney Admit Fiscal Commission is Designed to Push Tax Hikes

Spending & Regulatory Reform, Tax Reform

Pro-Tax Hike CRFB Pushes for Romney’s Tax-Trap Commission

Healthcare

Senate HELP Committee to Hold Hearing on Prescription Drug Prices

Healthcare

Medicare Advantage Report Ignores Benefits of Competition in Program

Healthcare, Property Rights

ATR Submits Comments Opposing Misuse of Bayh-Dole March-In Rights