Featured Posts

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Tax Reform

Biden: Tax cuts “are going to stay expired and dead forever if I’m re-elected.”

Biden announces intention to break his $400k tax pledge Today President Biden said that if elected to a second term he will make sure…

Taxpayer Protection Pledge

Brad Knott Makes “No New Taxes” Promise to Voters in NC-13 Run-off

Americans for Tax Reform (ATR) commends former federal prosecutor Brad Knott for signing the Taxpayer Protection Pledge,…

Filtered Posts

Healthcare

JAMA Study on Price of Diabetes Medicines is Deceiving and Threatens Medical Innovation

Spending & Regulatory Reform, Tax Reform

RSC Budget Calls for Pro-Growth Tax Cuts and Restraints on Spending

Healthcare

Biden Budget Would Expand Devastating Drug Price Controls

Healthcare

ATR Urges Lawmakers to Oppose Bill that Undermines the Contact Lens Rule

Spending & Regulatory Reform, Tax Reform

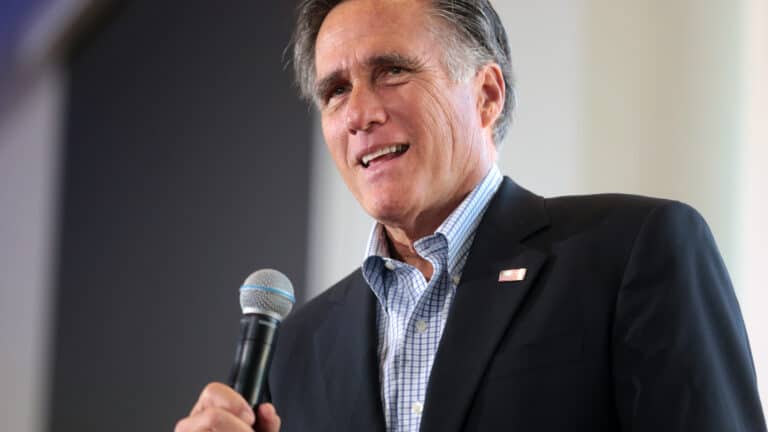

Arrington, Romney Admit Fiscal Commission is Designed to Push Tax Hikes

Spending & Regulatory Reform, Tax Reform

Pro-Tax Hike CRFB Pushes for Romney’s Tax-Trap Commission

Healthcare

Senate HELP Committee to Hold Hearing on Prescription Drug Prices

Healthcare

Medicare Advantage Report Ignores Benefits of Competition in Program

Healthcare, Property Rights

ATR Submits Comments Opposing Misuse of Bayh-Dole March-In Rights