Featured Posts

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Financial Services

ATR Supports Fight Against SEC’s Climate Rule

On March 21, 2022, the Securities and Exchange Commission (SEC) introduced a proposed rulemaking that required publicly traded companies to disclose information…

Financial Services

ATR Supports Fight Against CFPB’s Credit Card Late Fee Rule

Without any direction from Congress, the Consumer Financial Protection Bureau (CFPB) finalized a rule that (1) changes the safe harbor dollar amount for late fees…

Filtered Posts

Healthcare

JAMA Study on Price of Diabetes Medicines is Deceiving and Threatens Medical Innovation

Spending & Regulatory Reform, Tax Reform

RSC Budget Calls for Pro-Growth Tax Cuts and Restraints on Spending

Healthcare

Biden Budget Would Expand Devastating Drug Price Controls

Healthcare

ATR Urges Lawmakers to Oppose Bill that Undermines the Contact Lens Rule

Spending & Regulatory Reform, Tax Reform

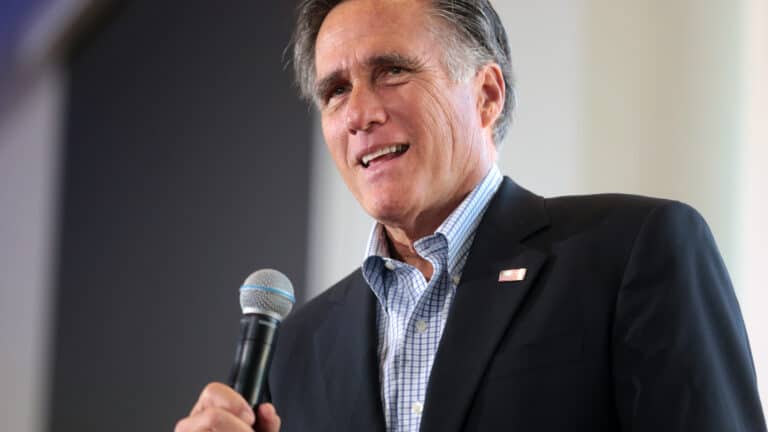

Arrington, Romney Admit Fiscal Commission is Designed to Push Tax Hikes

Spending & Regulatory Reform, Tax Reform

Pro-Tax Hike CRFB Pushes for Romney’s Tax-Trap Commission

Healthcare

Senate HELP Committee to Hold Hearing on Prescription Drug Prices

Healthcare

Medicare Advantage Report Ignores Benefits of Competition in Program

Healthcare, Property Rights

ATR Submits Comments Opposing Misuse of Bayh-Dole March-In Rights