Featured Posts

Taxpayer Protection Pledge

Lt. Gov. Nancy Dahlstrom First To Make “No New Taxes” Promise to Voters in Alaska Congressional Race

Americans for Tax Reform (ATR) commends Alaska Lieutenant Governor Nancy Dahlstrom for signing the Taxpayer Protection Pledge, a written commitment to the…

Financial Services

ATR Remains Opposed to Credit Card Competition Act

Americans for Tax Reform is opposed to the Credit Card Competition Act (CCCA), whether it is considered by itself or as part of a larger…

Tax Reform

Yellen Feigns Ignorance of Biden Vow to End the Trump Tax Cuts

Biden said Trump-enacted tax cuts “are going to stay expired and dead forever if I’m re-elected.” In a House Ways and Means Committee…

Filtered Posts

Spending & Regulatory Reform, Tax Reform

Worst of Both Worlds: U.S. Economic Growth Slows as Inflation Rates Rise

Healthcare

JAMA Study on Price of Diabetes Medicines is Deceiving and Threatens Medical Innovation

Spending & Regulatory Reform, Tax Reform

RSC Budget Calls for Pro-Growth Tax Cuts and Restraints on Spending

Healthcare

Biden Budget Would Expand Devastating Drug Price Controls

Healthcare

ATR Urges Lawmakers to Oppose Bill that Undermines the Contact Lens Rule

Spending & Regulatory Reform, Tax Reform

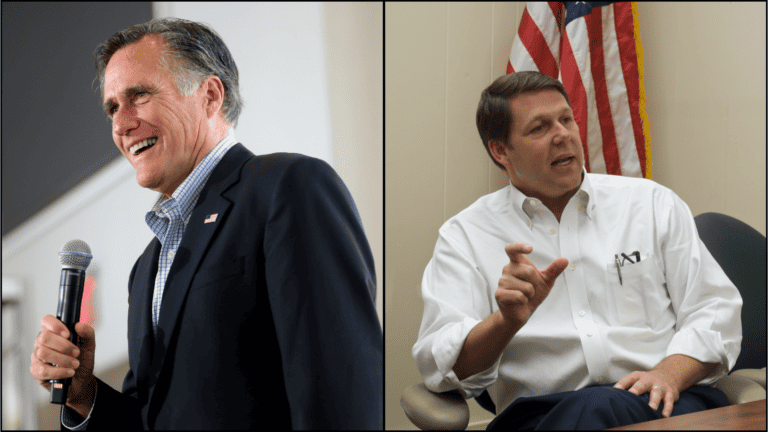

Arrington, Romney Admit Fiscal Commission is Designed to Push Tax Hikes

Spending & Regulatory Reform, Tax Reform

Pro-Tax Hike CRFB Pushes for Romney’s Tax-Trap Commission

Healthcare

Senate HELP Committee to Hold Hearing on Prescription Drug Prices

Healthcare

Medicare Advantage Report Ignores Benefits of Competition in Program

Healthcare, Property Rights