Featured Posts

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Tax Reform

Biden: Tax cuts “are going to stay expired and dead forever if I’m re-elected.”

Biden announces intention to break his $400k tax pledge Today President Biden said that if elected to a second term he will make sure…

Taxpayer Protection Pledge

Brad Knott Makes “No New Taxes” Promise to Voters in NC-13 Run-off

Americans for Tax Reform (ATR) commends former federal prosecutor Brad Knott for signing the Taxpayer Protection Pledge,…

Filtered Posts

Now With More Ban, Still No Facts, Straw Panic Hits D.C.

CT: Lamont Promises to Raise Taxes, Stefanowski, Over Two Dozen GOP Candidates Pledge to Oppose Tax Hikes

Congestion Pricing is a Tax

After NJ Governor Spearheads $1B-plus Tax Hike, Unions Get Big Payday

NJ Legislator Pushes Water Tax. What’s Next? Taxing Air?

In the Wake of Wayfair, Massachusetts Wants Every Penny It Can Get

Pennsylvania Budget Signed, Sealed, Delivered Without Tax Hikes Thanks to Helping Hand from Federal Reform

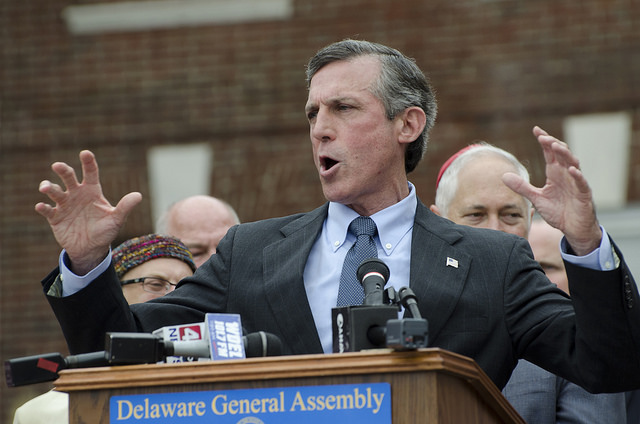

Delaware State Employees Get a Trump Tax Reform Bonus as Gov. Carney Signs 2019 Budget

NJ Legislative Majority Pushes Bag Tax to Help Their Bottom-Line, Not the Environment