Featured Posts

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Financial Services

ATR Supports Fight Against SEC’s Climate Rule

On March 21, 2022, the Securities and Exchange Commission (SEC) introduced a proposed rulemaking that required publicly traded companies to disclose information…

Filtered Posts

Now With More Ban, Still No Facts, Straw Panic Hits D.C.

CT: Lamont Promises to Raise Taxes, Stefanowski, Over Two Dozen GOP Candidates Pledge to Oppose Tax Hikes

Congestion Pricing is a Tax

After NJ Governor Spearheads $1B-plus Tax Hike, Unions Get Big Payday

NJ Legislator Pushes Water Tax. What’s Next? Taxing Air?

In the Wake of Wayfair, Massachusetts Wants Every Penny It Can Get

Pennsylvania Budget Signed, Sealed, Delivered Without Tax Hikes Thanks to Helping Hand from Federal Reform

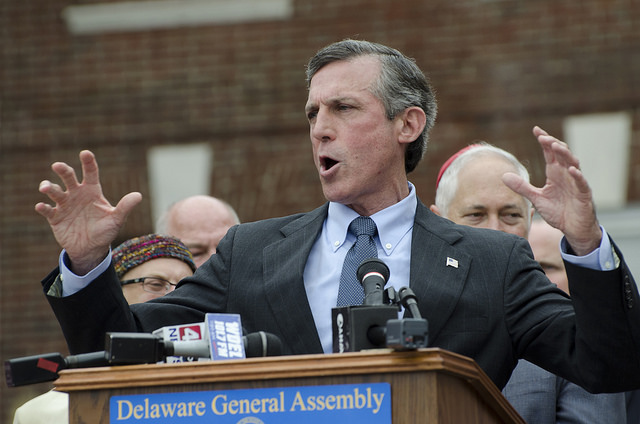

Delaware State Employees Get a Trump Tax Reform Bonus as Gov. Carney Signs 2019 Budget

NJ Legislative Majority Pushes Bag Tax to Help Their Bottom-Line, Not the Environment