Featured Posts

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Filtered Posts

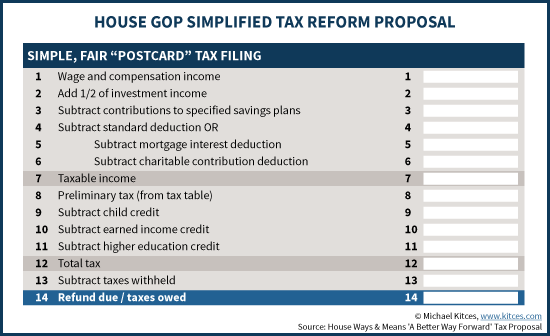

IRS Chief: We are running out of space on the 1040

Grover Norquist: Tax Reform Should Be Permanent

Norquist on Infrastructure: Time to Abolish Davis-Bacon

Fox News: 73% of Americans Want Tax Reform

Norquist: Obamacare Repeal Must Come Before Tax Reform, “Because The Alternative Is Too Awful.”

Norquist: AHCA is One of the Most Conservative Pieces of Legislation DC Has Ever Seen

Repeal Bill Abolishes Obamacare’s Chronic Care Tax on Middle Class

Norquist On Tax Reform: “Voters Are Smarter Than The Democrats Think They Are.”

Norquist Praises House GOP Tax Plan