Featured Posts

Trade

ATR Applauds House Oversight For Investigating FTC-DOJ Strike Force

The House Committee on Oversight and Accountability is launching a probe into the rampant politicization of the Federal Trade Commission (FTC) by Chair Lina Khan…

Taxpayer Protection Pledge

ATR Commends Pennsylvania Pledge Signers Ahead of April 23 Primary

As Pennsylvania Primary voters head to the voting booth, they deserve to know where their candidates stand on crucial issues such as taxes and spending.

Conservative Movement Leaders Oppose Motion to Vacate

A coalition of more than 40 conservative movement leaders released a letter today urging the House to oppose a vote on the motion to vacate…

Filtered Posts

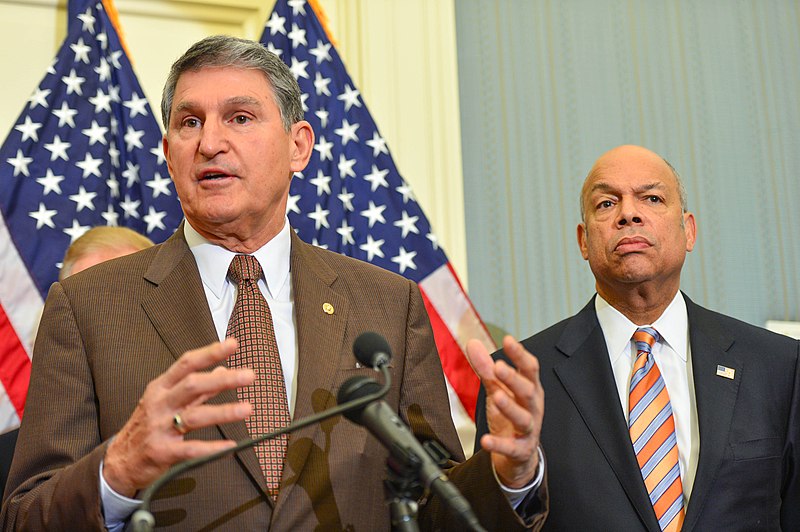

Video: “Forget it.” Joe Manchin Rules Out a Carbon Tax

5 Reasons Why Biden is Wrong to Kill the Keystone XL Pipeline

Au Revoir: US Officially Exits Paris Climate Accord

ATR Applauds Rep. Perry for Introducing the SWEET Act

5 Reasons to Oppose Hiking the Passenger Facility Charge

ATR Applauds Rep. Kevin Hern for Amendment Prohibiting a Carbon Tax