Featured Posts

Education

Biden’s Student Loan Cancellation Plan Will Only Worsen a Larger Problem in Higher Education

Last week, President Biden visited Madison, Wisconsin where he announced new details for his student debt cancellation plan. While this initiative promises immediate short-term financial…

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Spending & Regulatory Reform, Tax Reform

Worst of Both Worlds: U.S. Economic Growth Slows as Inflation Rates Rise

Today, the Commerce Department released a snapshot of its growth report for the first quarter. The country’s gross domestic product (GDP) grew by just…

Filtered Posts

Spending & Regulatory Reform, Tax Reform

New Jersey Governor Phil Murphy Betrays No Tax Increase Promise, Returns to Tax-and-Spend Ways

Criminal Justice

Missouri Closing in on Boosting Workforce, Public Safety with Clean Slate Legislation

Criminal Justice

Missouri Amendment Would Bring Twisted Incentives to Sheriff Pensions

Tax Reform

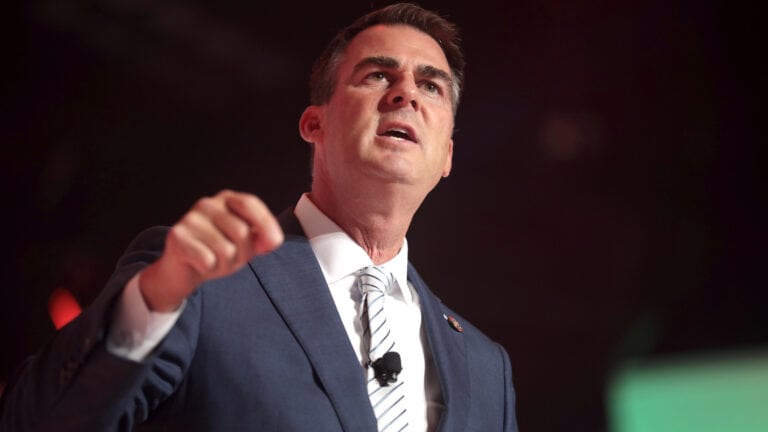

Big Win: Income Tax Elimination Plan Approved by Oklahoma House

Tax Reform

Oklahoma State of the State: Cut Taxes, Contain Spending to Keep Prosperity & Growth Going

Criminal Justice

Hearing on First Step Act Is a Reminder It’s Working

Criminal Justice

Signed, Sealed, Delivered: Pennsylvania Clean Slate 3.0 Enacted

Energy

Pennsylvania Gov. Shapiro Sues to Keep Carbon Tax & Unconstitutional Powers

Energy

Court Blocks Regional Carbon Tax Scheme in Pennsylvania

Tax Reform