Featured Posts

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Spending & Regulatory Reform, Tax Reform

Worst of Both Worlds: U.S. Economic Growth Slows as Inflation Rates Rise

Today, the Commerce Department released a snapshot of its growth report for the first quarter. The country’s gross domestic product (GDP) grew by just…

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Filtered Posts

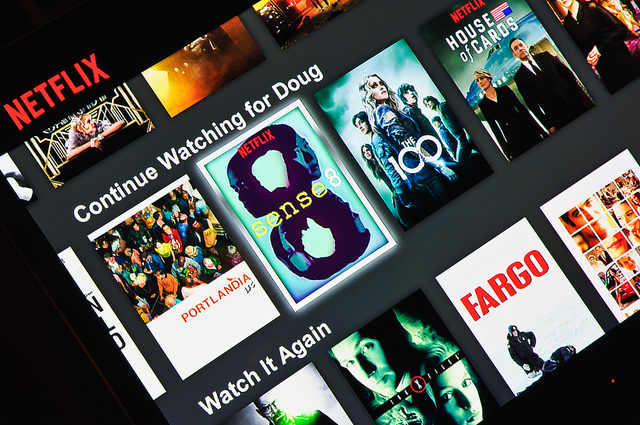

Netflix Users Win Big in Kentucky

Chicagoans Fight Back Against Amusement Tax Overreach

Sage Grouse Population Surging without ESA Listing

Even National Parks Can’t Comply with New EPA Regulations

Rep. Ratcliffe and Sen. Cruz Introduce Legislation to Dismantle the CFPB

5 Years Later: Dodd-Frank Continues to Cripple Small Business, Kill American Jobs

Crude Exports Would be a Boon for National Economy

Five Signs the Consumer Financial Protection Bureau is Asleep at the Wheel

EPA WOTUS Rule will Crush Property Rights and Cost Millions