Featured Posts

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Tax Reform

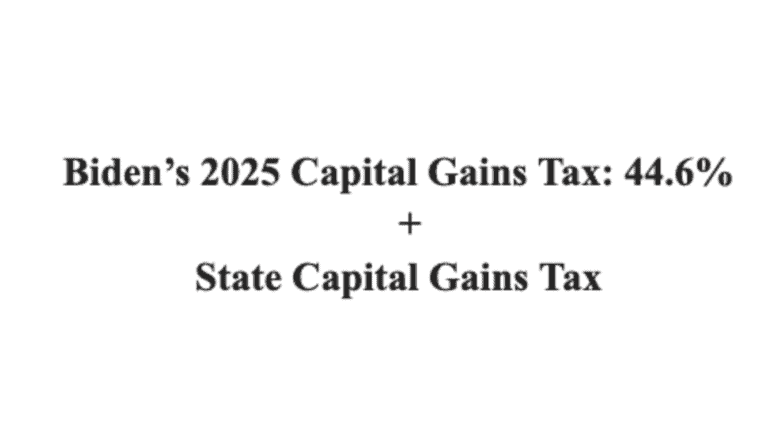

Biden Calls for 44.6% Capital Gains Tax Rate, Highest Capital Gains Tax Since Its Creation in 1922

And don’t forget to add the state capital gains tax: the Biden combined federal-state rate would exceed 50% in many states President Biden has…

Trade

ATR Applauds House Oversight For Investigating FTC-DOJ Strike Force

The House Committee on Oversight and Accountability is launching a probe into the rampant politicization of the Federal Trade Commission (FTC) by Chair Lina Khan…

Filtered Posts

Econ 101: Price Controls on Rent Would Cause Further Housing Shortages in CA

NJ Gov. Murphy Loses Budget Showdown

It’s a Miracle. NJ Legislature Passes Budget Without Murphy Tax Hikes

Michigan Governor Committed to Massive Gas Tax Hike

Illinois Legislature Passes Massive Tax Hike

Iowa Governor Signs Property Tax Transparency Bill into Law

PA Governor Wolf Has a New Excuse for Double Tax on Natural Gas