Featured Posts

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Filtered Posts

North Dakota Income Tax Elimination Still Alive as House Takes a Stand

States Say Yes to Second Chances

Carbon Tax Pushed By New Mexico Dems Would Raise Gas Taxes and Fees by 238%

Don’t Tread on Me: California Dems Introduce Tire Tax, Gun Tax, Water Tax, and Energy Tax

Third time will not be the charm for a carbon tax in Washington state

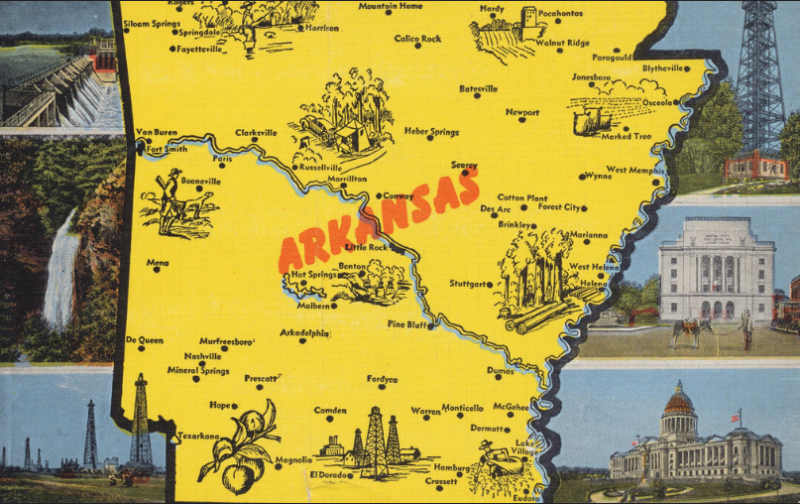

ATR Urges Arkansas Lawmakers to Reject Gas Tax Hike

Gov. Wolf Says He’s Not Asking for Tax Hike, While Proposing Tax Hike

CT Governor Goes From ‘No Tax’ Ned, to ‘New Tax’ Ned