Featured Posts

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Financial Services

ATR Supports Fight Against SEC’s Climate Rule

On March 21, 2022, the Securities and Exchange Commission (SEC) introduced a proposed rulemaking that required publicly traded companies to disclose information…

Financial Services

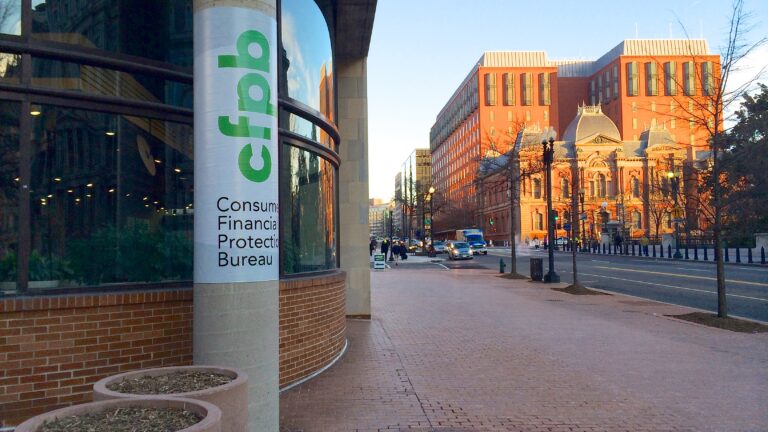

ATR Supports Fight Against CFPB’s Credit Card Late Fee Rule

Without any direction from Congress, the Consumer Financial Protection Bureau (CFPB) finalized a rule that (1) changes the safe harbor dollar amount for late fees…

Filtered Posts

Trade

EU Targets U.S. Companies Under New Digital Markets Act

Tax Reform

Biden’s Global Minimum Tax Cartel Hurts Americans

Regulation, Trade

Europe’s Attack on Apple: A Misguided Overstep

Regulation

Canada’s CRTC Attacks American Streaming Platforms – A Menace to Consumers And Innovation

Trade

USTR Announcement Is A Giveaway To Progressive Activists

Tax Reform

ATR President Grover Norquist Supports Hungary’s Rejection of Global Minimum Tax Proposal

Tax Reform

ATR Statement: EU’s Digital Markets Act Undermines Transatlantic Security

Tax Reform

USTR Must Strongly Oppose Canada’s Digital Tax on American Companies

Taxpayer Groups from 40 Countries Urge Rejection of OECD’s Global Minimum Tax