Featured Posts

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

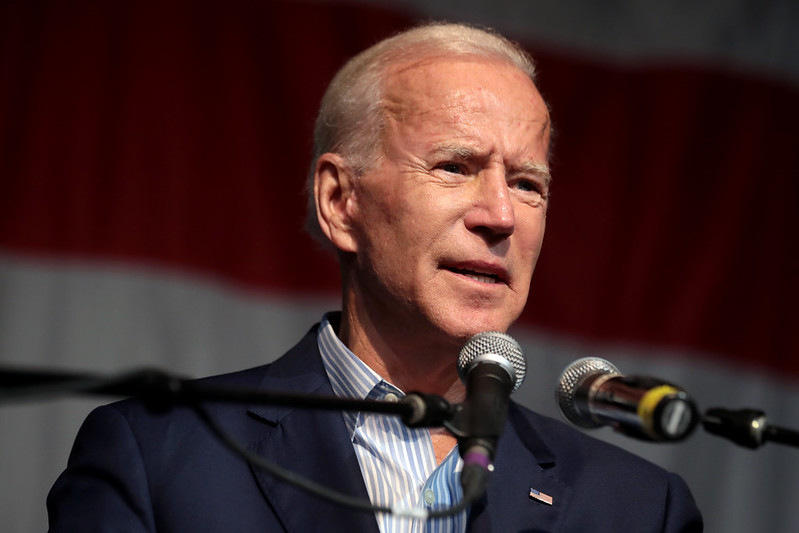

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Filtered Posts

Flashback: IRS Agents Accused of “Military Style Raids,” Harassed Children & Small Business Owners

Biden Plan to Repeal IDCs Threatens Manufacturing Jobs, Raises Energy Costs

Democrats’ $30 Billion Small Business Tax Hike Violates Biden Tax Pledge

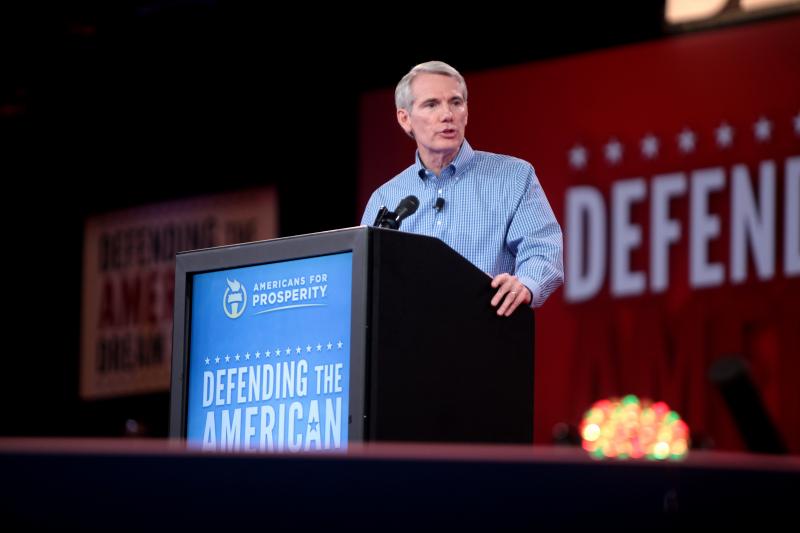

Senator Rob Portman Unveils Bipartisan Retirement Reform Bill

The Save American Workers Act Protects Small Businesses From Obamacare Taxes

Norquist Praises Release of Tax Reform 2.0

Trump Should Appoint an Ambassador to the OECD to Defend Pro-Growth Tax Reform

In Victory for Free Speech, Trump Admin Rolls Back Schedule B Disclosure Requirements