Featured Posts

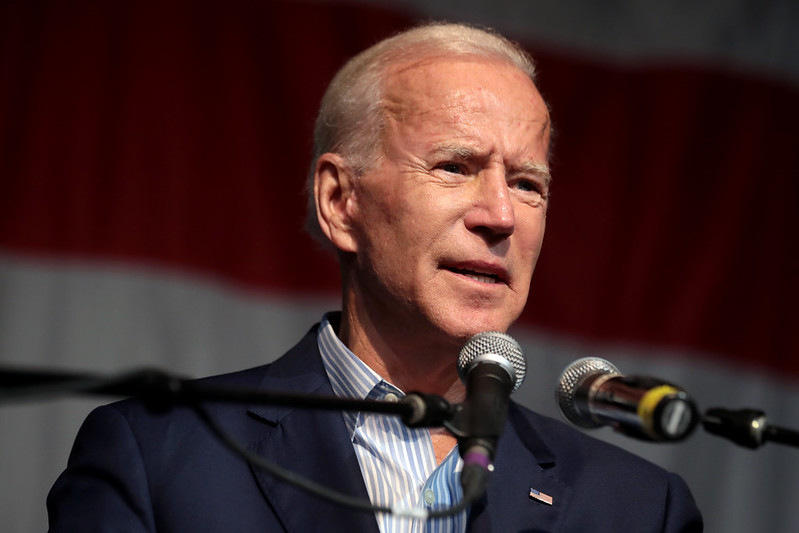

Biden Calls for 44.6% Capital Gains Tax Rate, Highest Capital Gains Tax Since Its Creation in 1922

And don’t forget to add the state capital gains tax: the Biden combined federal-state rate would exceed 50% in many states President Biden has…

Trade

ATR Applauds House Oversight For Investigating FTC-DOJ Strike Force

The House Committee on Oversight and Accountability is launching a probe into the rampant politicization of the Federal Trade Commission (FTC) by Chair Lina Khan…

Taxpayer Protection Pledge

ATR Commends Pennsylvania Pledge Signers Ahead of April 23 Primary

As Pennsylvania Primary voters head to the voting booth, they deserve to know where their candidates stand on crucial issues such as taxes and spending.

Filtered Posts

Flashback: IRS Agents Accused of “Military Style Raids,” Harassed Children & Small Business Owners

Biden Plan to Repeal IDCs Threatens Manufacturing Jobs, Raises Energy Costs

Democrats’ $30 Billion Small Business Tax Hike Violates Biden Tax Pledge

Senator Rob Portman Unveils Bipartisan Retirement Reform Bill

The Save American Workers Act Protects Small Businesses From Obamacare Taxes

Norquist Praises Release of Tax Reform 2.0

Trump Should Appoint an Ambassador to the OECD to Defend Pro-Growth Tax Reform

In Victory for Free Speech, Trump Admin Rolls Back Schedule B Disclosure Requirements