Featured Posts

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Tax Reform

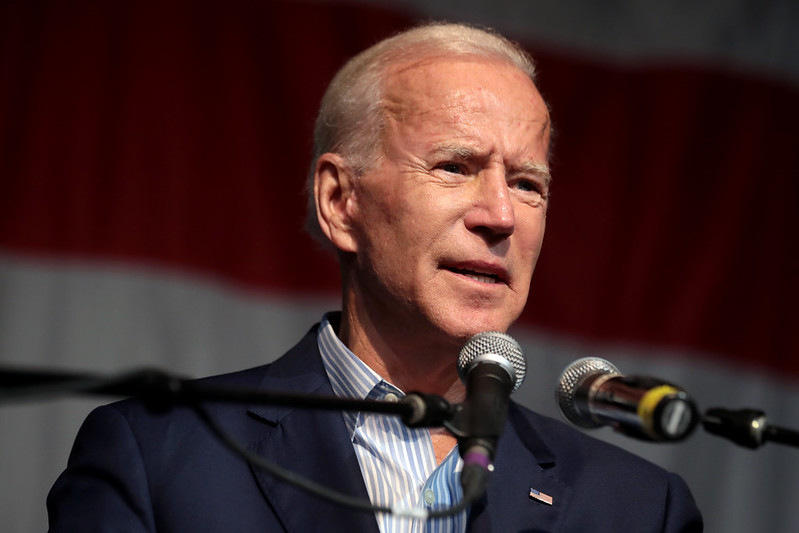

Biden: Tax cuts “are going to stay expired and dead forever if I’m re-elected.”

Biden announces intention to break his $400k tax pledge Today President Biden said that if elected to a second term he will make sure…

Taxpayer Protection Pledge

Brad Knott Makes “No New Taxes” Promise to Voters in NC-13 Run-off

Americans for Tax Reform (ATR) commends former federal prosecutor Brad Knott for signing the Taxpayer Protection Pledge,…

Filtered Posts

Flashback: IRS Agents Accused of “Military Style Raids,” Harassed Children & Small Business Owners

Biden Plan to Repeal IDCs Threatens Manufacturing Jobs, Raises Energy Costs

Democrats’ $30 Billion Small Business Tax Hike Violates Biden Tax Pledge

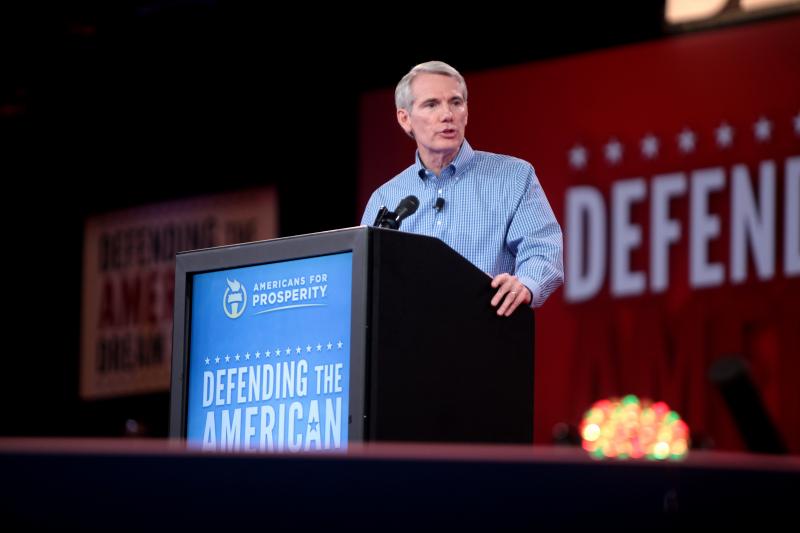

Senator Rob Portman Unveils Bipartisan Retirement Reform Bill

The Save American Workers Act Protects Small Businesses From Obamacare Taxes

Norquist Praises Release of Tax Reform 2.0

Trump Should Appoint an Ambassador to the OECD to Defend Pro-Growth Tax Reform

In Victory for Free Speech, Trump Admin Rolls Back Schedule B Disclosure Requirements