Featured Posts

Consumer Affairs, Vaping

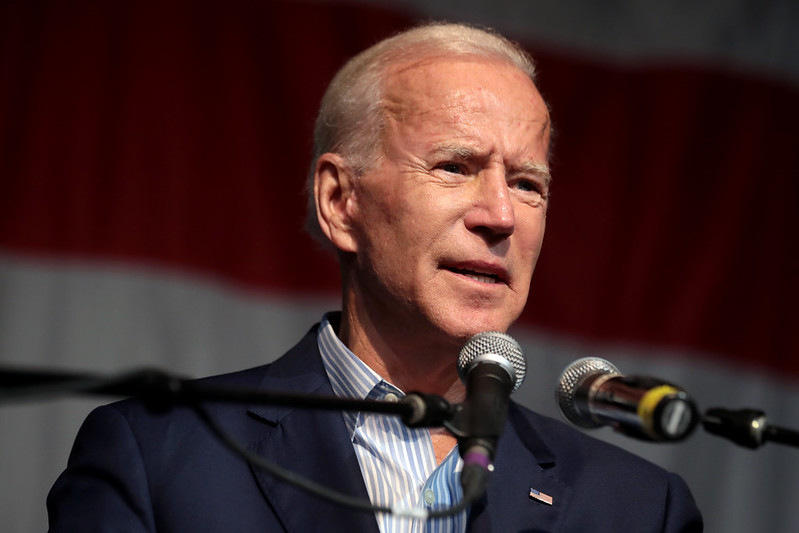

Biden Abandons Disastrous Menthol Prohibition Plan; Now Washington Needs To Embrace Harm Reduction

In a rare recognition of reality, the Biden Administration today finally agreed to drop their deeply flawed plans to introduce prohibition for Menthol cigarettes…

Education

Biden’s Student Loan Cancellation Plan Will Only Worsen a Larger Problem in Higher Education

Last week, President Biden visited Madison, Wisconsin where he announced new details for his student debt cancellation plan. While this initiative promises immediate short-term financial…

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Filtered Posts

Flashback: IRS Agents Accused of “Military Style Raids,” Harassed Children & Small Business Owners

Biden Plan to Repeal IDCs Threatens Manufacturing Jobs, Raises Energy Costs

Democrats’ $30 Billion Small Business Tax Hike Violates Biden Tax Pledge

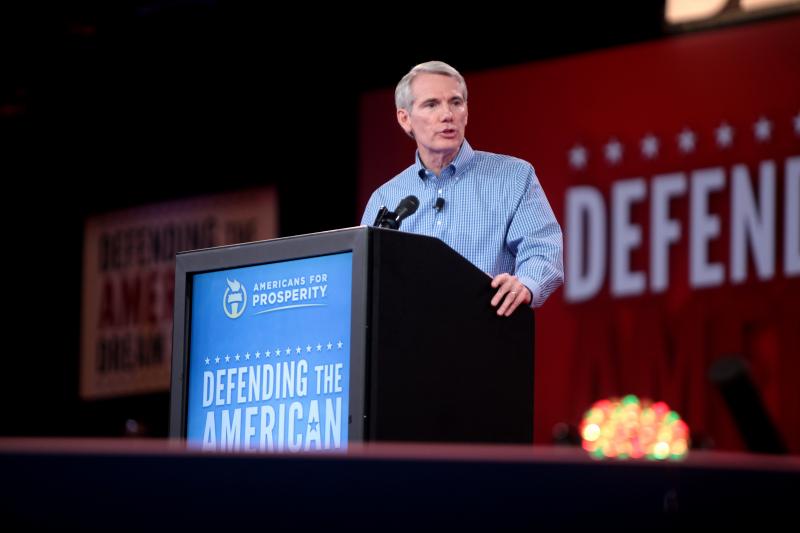

Senator Rob Portman Unveils Bipartisan Retirement Reform Bill

The Save American Workers Act Protects Small Businesses From Obamacare Taxes

Norquist Praises Release of Tax Reform 2.0

Trump Should Appoint an Ambassador to the OECD to Defend Pro-Growth Tax Reform

In Victory for Free Speech, Trump Admin Rolls Back Schedule B Disclosure Requirements