Featured Posts

Tax Reform

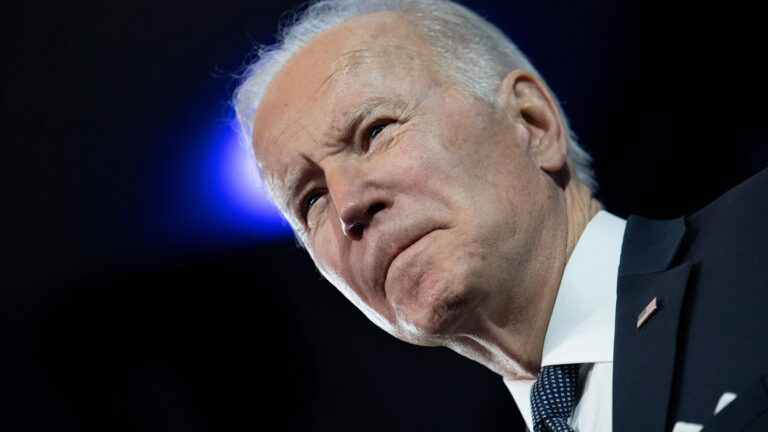

Biden: Tax cuts “are going to stay expired and dead forever if I’m re-elected.”

Biden announces intention to break his $400k tax pledge Today President Biden said that if elected to a second term he will make sure…

Taxpayer Protection Pledge

Brad Knott Makes “No New Taxes” Promise to Voters in NC-13 Run-off

Americans for Tax Reform (ATR) commends former federal prosecutor Brad Knott for signing the Taxpayer Protection Pledge,…

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Filtered Posts

Tax Reform

Senate Democrats Pushing $250B Small Business Tax Hike

Healthcare, Spending & Regulatory Reform

Senators Should Oppose the Pharmacy Benefit Manager Transparency Act

Tax Reform

Five Tax Cuts in the RSC Budget That Will Grow the Economy and Help the Middle Class

Spending & Regulatory Reform, Tax Reform

Biden Admin Policies Will Harm, Not Help Inflation

Tax Reform

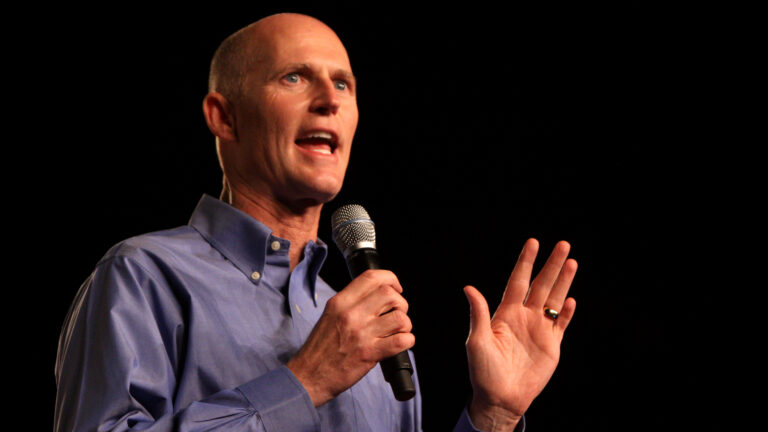

Five Reasons Conservatives Should Oppose Sen. Rick Scott’s “Skin in the Game” Tax Hike

Tax Reform

Ten Reasons to be Concerned with Biden’s 20 Percent Tax on Unrealized Gains

Tax Reform

IRS Data: Trump Tax Cuts Benefited Indiana Middle Class Taxpayers

Spending & Regulatory Reform

Manchin’s Call to Repeal Trump Tax Cuts Will Harm West Virginians

Tax Reform

House Dems Should Not Force Vote on Socialist Tax and Spend Bill Without CBO Score

Healthcare, Tax Reform