Featured Posts

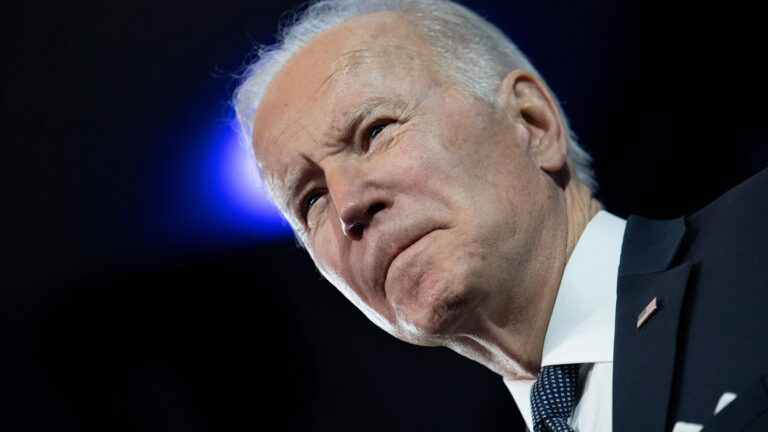

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Financial Services

ATR Supports Fight Against SEC’s Climate Rule

On March 21, 2022, the Securities and Exchange Commission (SEC) introduced a proposed rulemaking that required publicly traded companies to disclose information…

Filtered Posts

Tax Reform

Senate Democrats Pushing $250B Small Business Tax Hike

Healthcare, Spending & Regulatory Reform

Senators Should Oppose the Pharmacy Benefit Manager Transparency Act

Tax Reform

Five Tax Cuts in the RSC Budget That Will Grow the Economy and Help the Middle Class

Spending & Regulatory Reform, Tax Reform

Biden Admin Policies Will Harm, Not Help Inflation

Tax Reform

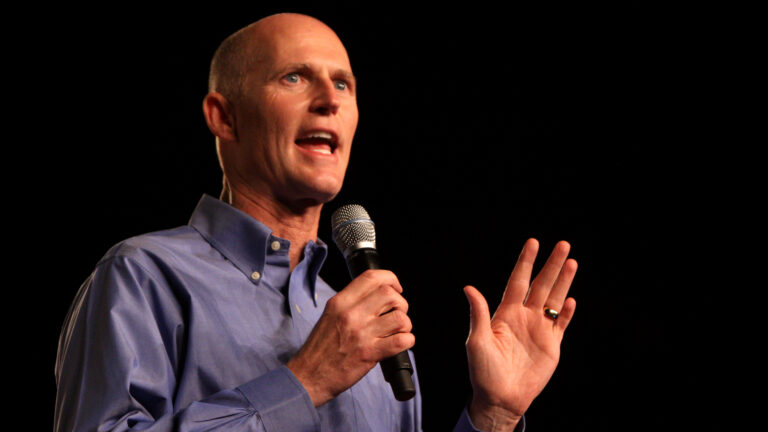

Five Reasons Conservatives Should Oppose Sen. Rick Scott’s “Skin in the Game” Tax Hike

Tax Reform

Ten Reasons to be Concerned with Biden’s 20 Percent Tax on Unrealized Gains

Tax Reform

IRS Data: Trump Tax Cuts Benefited Indiana Middle Class Taxpayers

Spending & Regulatory Reform

Manchin’s Call to Repeal Trump Tax Cuts Will Harm West Virginians

Tax Reform

House Dems Should Not Force Vote on Socialist Tax and Spend Bill Without CBO Score

Healthcare, Tax Reform