Featured Posts

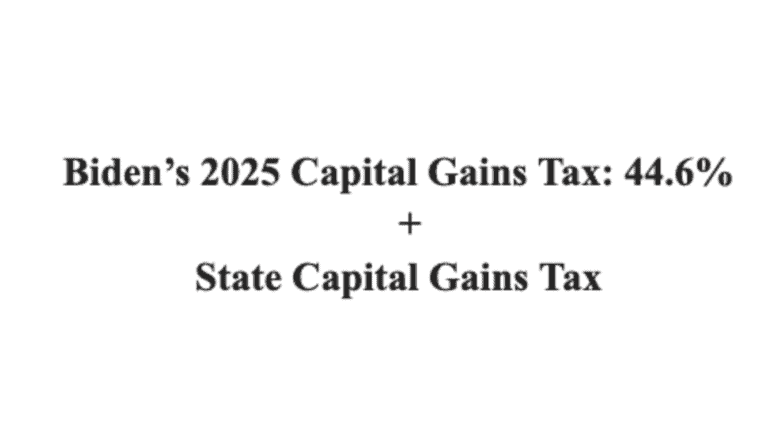

Biden Calls for 44.6% Capital Gains Tax Rate, Highest Capital Gains Tax Since Its Creation in 1922

And don’t forget to add the state capital gains tax: the Biden combined federal-state rate would exceed 50% in many states President Biden has…

Trade

ATR Applauds House Oversight For Investigating FTC-DOJ Strike Force

The House Committee on Oversight and Accountability is launching a probe into the rampant politicization of the Federal Trade Commission (FTC) by Chair Lina Khan…

Taxpayer Protection Pledge

ATR Commends Pennsylvania Pledge Signers Ahead of April 23 Primary

As Pennsylvania Primary voters head to the voting booth, they deserve to know where their candidates stand on crucial issues such as taxes and spending.

Filtered Posts

Tax Reform

Senate Democrats Pushing $250B Small Business Tax Hike

Healthcare, Spending & Regulatory Reform

Senators Should Oppose the Pharmacy Benefit Manager Transparency Act

Tax Reform

Five Tax Cuts in the RSC Budget That Will Grow the Economy and Help the Middle Class

Spending & Regulatory Reform, Tax Reform

Biden Admin Policies Will Harm, Not Help Inflation

Tax Reform

Five Reasons Conservatives Should Oppose Sen. Rick Scott’s “Skin in the Game” Tax Hike

Tax Reform

Ten Reasons to be Concerned with Biden’s 20 Percent Tax on Unrealized Gains

Tax Reform

IRS Data: Trump Tax Cuts Benefited Indiana Middle Class Taxpayers

Spending & Regulatory Reform

Manchin’s Call to Repeal Trump Tax Cuts Will Harm West Virginians

Tax Reform

House Dems Should Not Force Vote on Socialist Tax and Spend Bill Without CBO Score

Healthcare, Tax Reform