Featured Posts

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Filtered Posts

Obamacare Individual Mandate Devastates Families and Businesses

Show Notes: How Obama’s Labor Department Gets Between You and Your Savings

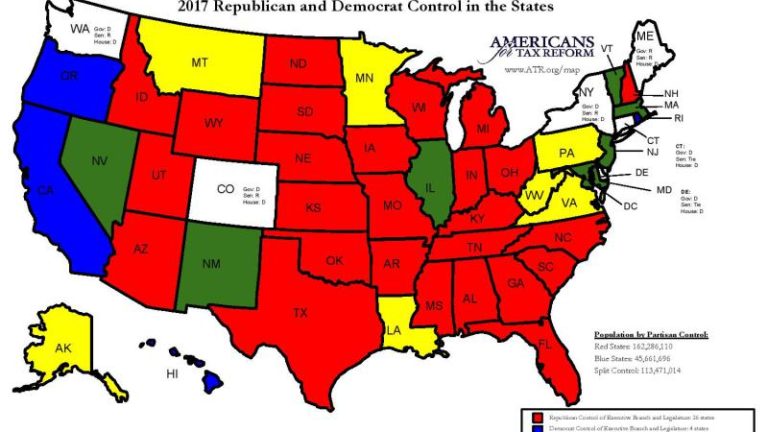

Show Notes: Taxpayers Win Big on Election Day

Show Notes: What the Election Results Mean for American Taxpayers

Show Notes: The Hypocrisy of the Death Tax

Conservatives Should Focus on Governing from Congress

Show Notes: Win, Lose, or Draw Republicans Should Govern from Congress

Show Notes: Hillary Clinton’s Tax Hike Plan

Show Notes: Empower Real Americans’ Voices in Presidential Debates