Featured Posts

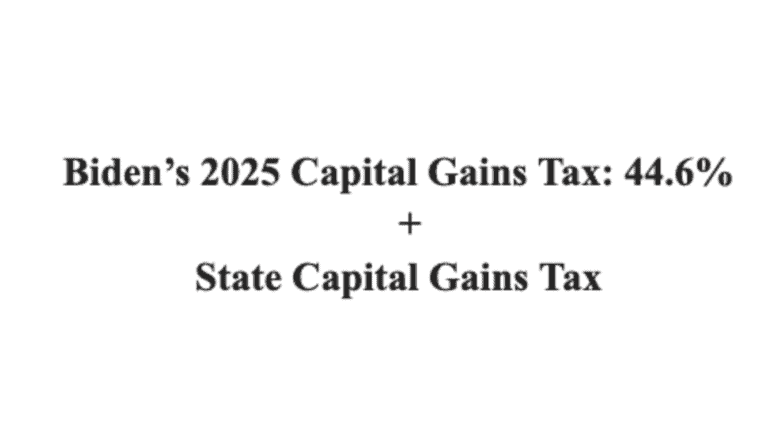

Biden Calls for 44.6% Capital Gains Tax Rate, Highest Capital Gains Tax Since Its Creation in 1922

And don’t forget to add the state capital gains tax: the Biden combined federal-state rate would exceed 50% in many states President Biden has…

Trade

ATR Applauds House Oversight For Investigating FTC-DOJ Strike Force

The House Committee on Oversight and Accountability is launching a probe into the rampant politicization of the Federal Trade Commission (FTC) by Chair Lina Khan…

Taxpayer Protection Pledge

ATR Commends Pennsylvania Pledge Signers Ahead of April 23 Primary

As Pennsylvania Primary voters head to the voting booth, they deserve to know where their candidates stand on crucial issues such as taxes and spending.

Filtered Posts

Buttigieg Would Repeal the Entire Trump Tax Cut

How the Trump Tax Cuts Have Helped Ohio

Biden Lies About Trump GOP Tax Cut, Claims It “Affected Very Few People”

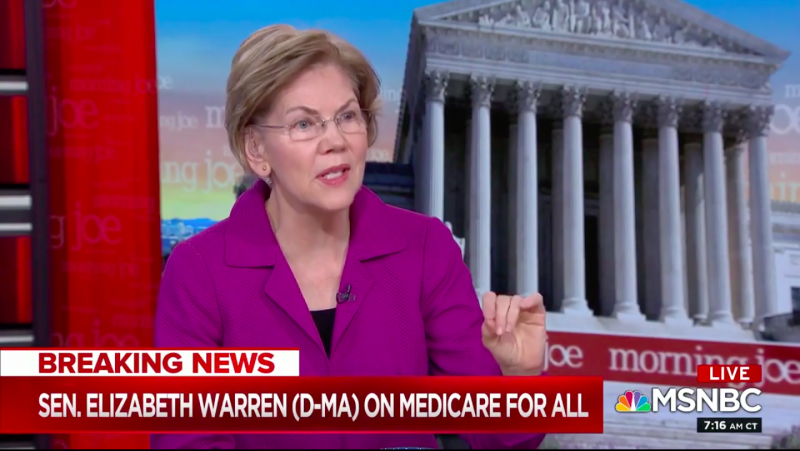

Warren Tells Another Lie on The View: “I Don’t Have Plans That Increase Taxes On The Middle Class.”

Warren Dodges Private Healthcare Question Three Times During Morning Joe Interview

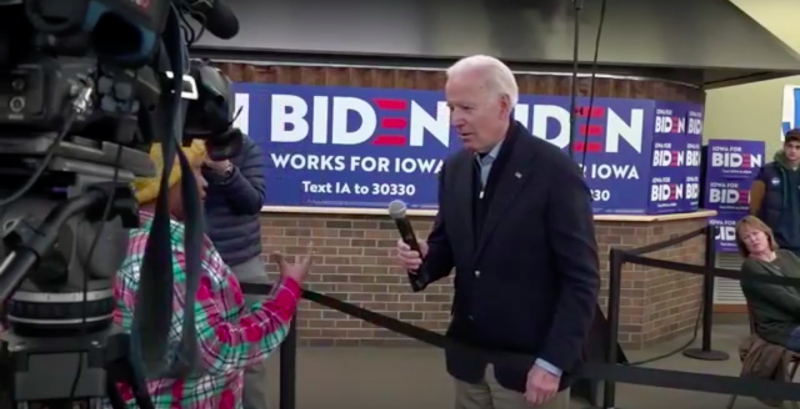

Biden Calls for Plastic Bag Ban: “We should not be allowing plastic.”

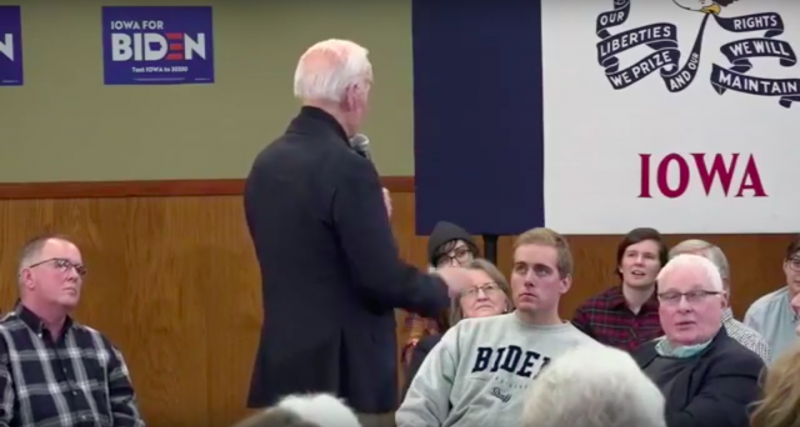

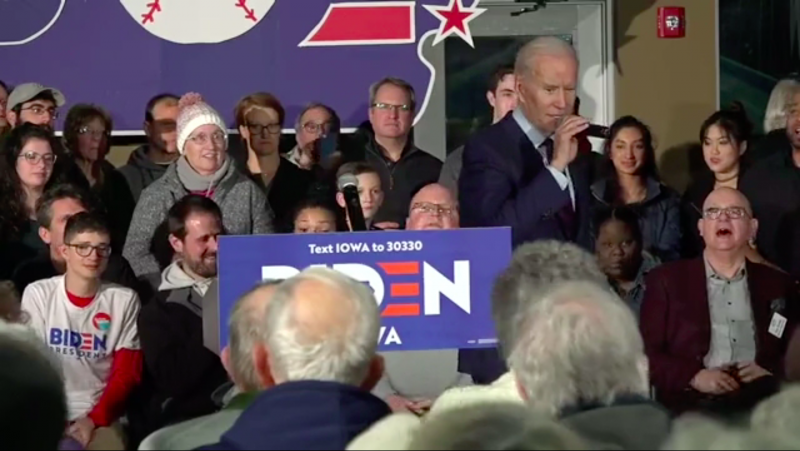

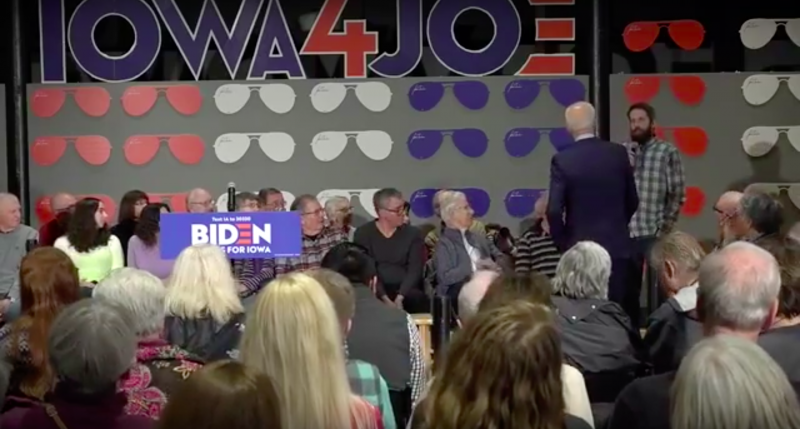

Biden: “Get Rid of the Trump Tax Cut”

Joe Biden Suggests He Would “Eliminate” Vaping If Elected

Pete Buttigieg: “We Gotta Roll Back the Trump Tax Cuts for Corporations”